Nov 3, 2018 | Investment Basics, Option Trading Basics, Stock Investing

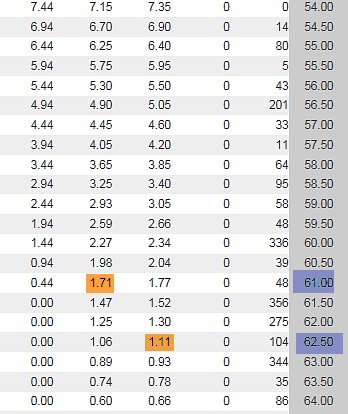

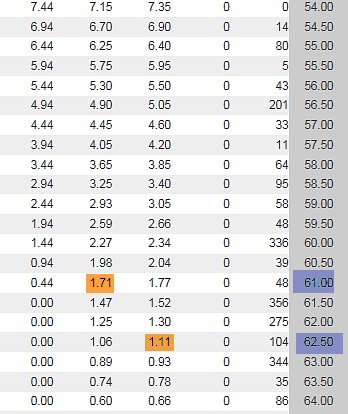

One of the BCI guidelines for selling covered call and cash-secured put options is that we require a bid-ask spread of $0.30 or less and/or an open interest of 100 contracts or more. Typically, options with large open interest will also be associated with smaller...

Feb 4, 2017 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Covered call writers, historically, have ignored exit strategies as part of their investment approach. Certainly, not in the BCI community but most everywhere else. As we become aware of the major financial benefits of mastering the position management skill, we...

Feb 1, 2014 | Investment Basics, Option Trading Basics, Stock Option Strategies

Our study of option trading basics and stock option strategies involves an analysis of implied volatility. This is the market’s forecast of the underlying security’s volatility as implied by the option’s price in the market place. Frequently, the...

Nov 9, 2013 | Investment Basics, Option Trading Basics, Options Trade Execution, Stock Option Strategies

Our covered call writing strategy involves both buying and selling options. Mastering our options trade executions can bring our profit level to even higher levels. We know that a general rule is that we buy at the “bid” (the lower figure) and sell at the...

Dec 29, 2012 | Investment Basics, Option Trading Basics, Stock Investing, Stock Option Strategies

When studying investment basics, the term slippage has two applications. In general, it means having a trade executed at a price less favorable to the trader. Let’s look at the two areas where we may see this term used: An order is executed at a worse-than-expected...