Portfolio overwriting is a covered call writing-like strategy where we sell call options against long-term buy-and-hold securities. Generally, these are low-cost basis stocks that are dividend-bearing and trading in non-sheltered […]

Rolling Out-And-Up in Our Buy-And-Hold Portfolios

Posted on October 28, 2017 by Alan Ellman in Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Rolling Out-and-Up After Understanding the Math

Posted on December 31, 2016 by Alan Ellman in Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

Elite covered call writers understand the importance of position management in maximizing returns. As a result, I receive a significant number of inquiries regarding exit strategy execution. This article will […]

Rolling Options Using the Ellman Calculator

Posted on August 13, 2016 by Alan Ellman in Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Covered call writing and put-selling are strategies that require us to master three skills: stock selection, option selection and position management or the use of exit strategies. One of the […]

Evaluating Returns When Rolling Out And Up

Posted on March 28, 2015 by Alan Ellman in Covered Call Exit Strategies, Exit Strategies, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

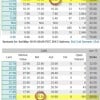

Covered call writing and put-selling calculations must be accurate and preferably understood by option-sellers. I created the Ellman Calculators to facilitate the authentic computations we depend on. In this article, […]

Calculating 2-Month Returns When Rolling Out And Up

Posted on July 12, 2014 by Alan Ellman in Covered Call Exit Strategies, Exit Strategies, Option Trading Basics, Options Calculations, Stock Option Strategies

Options calculations will give us an accurate assessment of our covered call writing profits. It’s more meaningful to use percentages rather than dollar amounts when executing these calculations. For example, […]

Rolling Out And Up To Capture Share Appreciation: A Good Idea?

Posted on January 25, 2014 by Alan Ellman in Covered Call Exit Strategies, Option Trading Basics, Options Calculations, Stock Option Strategies

Covered call writing has some drawbacks as do all investment strategies. Profit limitation by the strike price is one such disadvantage. How do we manage a situation where the price […]

Technical Analysis and Covered Call Decisions: Looking Back At KORS

Posted on December 21, 2013 by Alan Ellman in Covered Call Exit Strategies, Investment Basics, Option Trading Basics, Stock Option Strategies, Technical Analysis

Technical analysis is an integral part of our covered call writing decisions for both stock and option selections. It also impacts our exit strategy decisions. KORS has been a favorite […]

Should I Roll My Option When The Stock Price Is DEEP In-The-Money?

Posted on May 18, 2013 by Alan Ellman in Covered Call Exit Strategies, Options Calculations, Options Trade Execution, Stock Option Strategies

Exit strategy execution is a critical skill every covered call writer should master. In addition to managing positions where share price has decreased there are also situations where we can […]

Rolling Strategies On Or Near Expiration Friday

Posted on November 12, 2011 by Alan Ellman in Covered Call Exit Strategies

With one week remaining before the expiration of the November option contracts I thought I’d use this week’s blog article to review the process of the rolling exit strategies. I […]

WHEN TO BUY BACK YOUR OPTION – EXPIRATION FRIDAY DILEMMA plus Industry in the Spotlight

Posted on August 10, 2008 by Alan Ellman in Covered Call Exit Strategies

Picture this: It’s on or near Expiration Friday and your stock or ETF (Exchange Traded Fund) is above the strike price. You know that if you do not act to institute […]

Podcast

Podcast

- 123. Implied Volatility, IV Rank and IV Percentile Defined and Practical Applications

- BCI PODCAST 122: Should I Roll-Out My Deep In-The-Money Call Option Mid-Contract?

- BCI PODCAST 121: What is a SPAC (Special Purpose Acquisition Company)?

- 120. Using the Nasdaq-100 Volatility Index (VOLQ) in Covered Call Writing Decisions

- 119. Establishing Our Cost-Basis for Long-Term Holdings

- 118. Adjusting Our Portfolio Mix to Achieve Diversification and Cash Allocation

- 117. When a Covered Call Strike Moves $1000.00 In-The-Money

- 116. How to Execute a Covered Call Trade with a Buy/Write Combination Form

- 115. Establishing Our Cost Basis When Rolling-Out-And-Up On 2 Different Days

- 114. The Poor Man's Covered Call Selecting the Best LEAPS Strikes

Subscribe To Our Free Newsletter

Categories

- Ask Alan (18)

- Covered Call Exit Strategies (233)

- Exchange-Traded Funds (65)

- Exit Strategies (230)

- Fundamental Analysis (52)

- Investment Basics (580)

- Just Alan (8)

- Option Trading Basics (595)

- Options Calculations (411)

- Options Trade Execution (232)

- paper trading (4)

- Podcasts (125)

- Put-selling (99)

- Stock Investing (118)

- Stock Option Strategies (548)

- Stock Trading & Taxes (20)

- Technical Analysis (49)

- Uncategorized (5)

Recent Posts

- Evaluating the Time Value Cost-To-Close to Assist in Covered Call Trade Decisions

- Ask Alan # 217: Entering a Poor Man’s Covered Call Trade

- Analyzing and Correcting Our Covered Call Writing Mistakes + Last Chance to Register for BCI Webinar

- BCI PODCAST 123: Implied Volatility, IV Rank and IV Percentile Defined and Practical Applications

Premium Membership

How Alan Got Started with Stock Options

Why Covered Call Options May Be Your Best Investing Strategy

Nasdaq Interviews Alan Ellman

© 2024 The Blue Collar Investor. All Rights Reserved.

Beginners Corner Enhanced & Updated

- Lesson 1: Beginner's Corner for Covered Call Writing: 2nd Edition

- Lesson 2: Beginner's Corner for Covered Call Writing- 2nd Edition: Option Basics

- Lesson 3: Beginner's Corner for Covered Call Writing- Stock Selection

- Lesson 4: Beginner's Corner for Covered Call Writing-2nd Edition

- Lesson 5: Beginner's Corner for Covered Call Writing

- Lesson 6: Beginner's Corner for Covered Call Writing

- Lesson 7: Beginner's Corner for Covered Call Writing: 2nd Edition

- Lesson 8: Beginner's Corner for Covered Call Writing

- Video 9: Premium Membership

Beginners Corner Selling-Puts

- Lesson 1: What Is Puts Selling?

- Lesson 2: Puts-Selling Option Basics

- Lesson 3:puts-selling-technical analysis

- Lesson 4:puts-selling-Common Sense Considerations

- Lesson 5:puts-selling-Calculating Returns

- Lesson 6:puts-selling-Executing Put-Selling

- Lesson 7:puts-selling- Exit Strategies

- Lesson 8:puts-selling-Mastering Put-Selling

Recent Comments