Covered call writing and put-selling generate monthly cash flow with the inherent risk of share depreciation. One of the major advantages of these conservative strategies is that they can be tailored to all market environments. In today’s article I will address one way to “stay in the game” even when market conditions are working against us as they have been recently with global economic concerns in China and Greece along with the technical breakdown last week at the New York Stock Exchange. Our goal is to achieve an annualized return of 10% per year in bear and volatile market conditions and NO this concept is NOT taken from the Bernie Madoff School of Sociopathic Investing!

Overall concept

- We will initiate our trade by selling a deep out-of-the-money cash-secured put targeting a 1%, one-month return

- If that option expires worthless, we continue to sell similar put options

- If exercised, the stock is purchased at the discounted strike price less put premium as our cost basis

- Once shares are purchased, in-the-money covered calls are sold targeting a 1%, one-month time value return

- With both calls and puts we select as deep out- or in-the-money strikes as possible while still approaching our one-month option profit goal

- We will assume no greater than a 1-month price decline of 5%, so if the put is exercised, it will be purchased near market price

- In the event that share decline is catastrophic, use of our exit strategy arsenal is essential

Real-life example

The challenge as I write this article is to find a security not reporting earnings prior to September 18, 2015 as I am crafting a two-month trade. Our Premium Watch List shows that Nike (NKE) is due to report on September 24, 2015 so that will represent our underlying security. The trades will initiate on July 9, 2015 and terminate on September 18, 2015. Here are the initial stats:

Entering the trade

- NKE is currently priced at $110.42

- The out-of-the-money August 21, 2015 $105.00 put generates a premium of $0.99, near our 1% target

- The in-the-money $105.00 call generates $6.43 of which $1.01 is time value, meeting our 1% target goal

- We will make the assumption that strikes that are in-the-money strikes by $5.00 in future months will also return about 1% in time value with the understanding that stock implied volatility may change

Calculating the out-of-the-money put

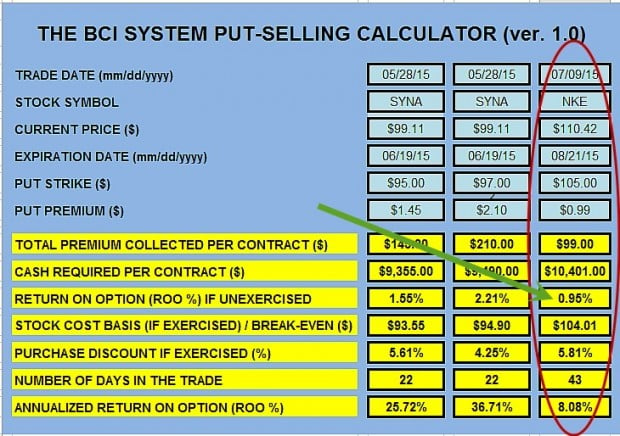

NKE: Calculating Put Options

Note the following

- NKE calculations are in the last column circled in red

- The return of the put option sale is 0.95% (green arrow)

- If exercised, our cost basis is $104.01, a discount of 5.81% from the price when the trade was initiated

Calculating the in-the-money call (in-the-money by approximately $5.00)

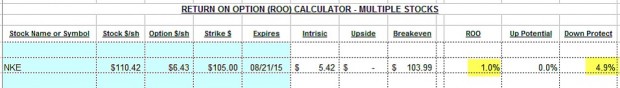

NKE: Calculating Call Options

Note the following

- The time value return by the strike about $5.00 in-the-money is 1%, meeting our target

- That profit is protected as long as NKE does not decline in value by more than 4.9%

- Our 10-week return in a bear market is 0.95% + 1.0% = 1.95% which annualized to our target of 10%

Discussion

This article was designed to show how flexible option-selling can be even in extreme bear and volatile markets. In order to accomplish this certain assumptions were made with the understanding that there are a myriad of exceptions that may occur. The concepts behind these assumptions, however, are “gold” and can be applied in countless other scenarios.

Coming soon

Complete Encyclopedia for Covered Call Writing- Volume 2

I spent four years writing the original Encyclopedia for Covered Call Writing which has remained the #1 best-seller on this topic on Amazon. Now four years later Volume 2 is almost ready and will be available later this summer.

Next live seminar

Market tone

Greece’s uncertain status and concerns regarding the declining economy in China subsided a bit on Thursday and Friday resulting in a partial market recovery. There are also concerns regarding the impact of Greece on other nations like Italy and Spain. How about the imminent reaction to the Fed raising short-term interest rates? I’m convinced that there will always be a reason for the market to be nervous. Next up…earnings season. Our best path is to stay focused on non-emotional investing and adhere to the guidelines and principles of a strategy we have confidence in. This week’s economic reports:

- The US labor market reported 5.36 million job openings in May, the highest since tracking began in December 2000

- The Institute for Supply Management services purchasing managers’ index rose from 55.7 in May to 56.0 in June

- The service sector PMI fell from 56.2 to 54.8 over the same period. Though moving in opposite directions, both gauges reflect expansion in US service sector activity last month.

- The US trade deficit widened to $41.9 billion in May

- Initial jobless claims rose 15,000 to 297,000 for the week ended 4 July, the 18th straight week below 300,000

- Continuing claims jumped 69,000 to 2.334 million for the week ending June 27th

For the week, the S&P 500 rose by 0.90% for a year-to-date return of 0.86.

Summary

IBD: Uptrend under pressure

GMI: 0/6- Sell signal since market close of June 30, 2015

BCI: Cautiously bullish but still selling an equal number of in-the-money and out-of-the-money strikes. I am more bullish on the upcoming earnings season than many of the economic experts and that is why I haven’t decreased the percentage of out-of-the-money strikes I’m currently using. Those less enthusiastic about upcoming earnings should consider a more conservative investment mix.

Wishing you the best in investing,

Alan ([email protected])

Alan,

I checked my online broker account and don’t see how to sell put options…just call options on the dropdown. Any suggestions are appreciated.

Jill

Jill,

Although the strategies are similar and the risk/reward profile graphs are precisely the same, most brokerages will require a higher level of trading approval for put-selling. Brokerages now have to answer to the SEC and FINRA for much of what they do (Know Your Customer rule) and the general thinking is that covered call writing is more intuitive for retail investors.

That said, you will need to contact your broker, request the appropriate level of trading approval for put-selling which will involve filling out a form detailing trading experience, investment goals and financial health.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 07/10/15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor Since are about to enter Earnings Season, be sure to read Alan’s article,

“Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Hi Alan,

Why IBD and GMI?

Thanks for the link. I didn’t know about GMI

Also, what if I sold a cc on a stock that has an earnings report coming up before expiry date? Look to buy it back before ER date? That’s what I’m going to do.

The more I learn; it seems the more I have to learn! But its fun. I’m enjoying it. Glued to the computer; trying to pace myself, but my wife misses me…

I’ve bought your books online (kindle versions). It works better for me. Fast delivery; easy to move around the book; highly portable; less expensive; but….the charts and figures are nearly impossible to read!! Oh well, by GMI-type standards that’s still a 4/5. Guess that’s a “buy”

Frank

Frank,

I show IBD and GMI overall market assessments to give perspectives other than mine. We use two IBD screens in our stocks analysis so I include their market analysis as well and the GMI is an excellent comprehensive technical evaluation of the overall market.

Yes the earnings report rule is critical in the BCI methodology…it is risk that can easily be avoided.

Charts crispness in kindle may differ from device to device. It’s an Amazon product. You will find the chart enhancements to be best in my upcoming book highlighted in this article.

Alan

Hello Alan,

I admire your undisturbed and cool stance concerning Grexit.

Fryday rally was an opportunity for me to sell some more of my positions, and I am now 40% in cash.

I believe Grexit is as risky as earnings report before expiry.

The 1% strategy at this precise moment seems to be too much risk for small reward, but I will revisit it next week, after the noise subsides.

Thanks for your help – Roni

Hey Roni,

I agree Alan is a cool customer – it takes a lot to rattle him :).

Since you sound experienced with options, as many on this blog are, another strategy I’ll toss out there is selling credit spreads.

Pick an index to trade: I use SPX. Then look on most charting software or eyeball it yourself for first and second level weekly support and resistance levels. They are called S1, S2, R1 and R2 – and no, they are not Star Wars robots 🙂

I sell put spreads just below S2 and call spreads just above R2 every week starting either Friday or on Monday after the weekend foreign news for the coming Friday expiration.

The market can never be two places at once. It takes a lot of news to bust the second level of Technicals either way in 5 or less days. Last week, for instance, after all the volatility the S&P closed flat. All my weekly spreads expired worthless. They became income and I start again. But that was a dream week for a spread seller! Often I have to do exit strategies one side or the other if the market has conviction and I sold a spread too close to the fire!

On Friday’s bounce I sold the SPX 2110/2115 call spread for this coming Friday. There was no “Greece Love In” today (Sunday) so I expect a lower open in the morning. I’ll sell a put spread to capitalize on their higher prices below the S&P 2040 S2 while my high side spread eats itself away in my favor.

It’s another tool worth looking into as we all grow skills in our shared hobby of selling options! – Jay

Hi Jay,

I am not very experienced (started in late 2010).

I follow Alan’s covered call method faithfully with great results.

Sometimes I also sell cash secured puts too.

Aiming at 2% minimum ROO, 30 to 35 days max. expiry, never later than earnings report date, and therefore mostly ATM strikes,

very diversified stocks, always buy/writes, and limit orders.

For selecting equities, I use mostly the green tickers from the BCI weekly report.

Also testing LEAP debit spreads on very strong names, like DIS, MA, WBA, which I watch very closely every day, and liquidate always when favorable.

Thank you very much for your tips on credit spreads, which I will now study carefully following your advice.

Cheers – Roni

Roni,

Thanks for the great teach and suggestion on LEAPS. I have never tried them but have read about them and will start some paper trades on the tickers you mention.

It is funny: since I started selling options I get less comfortable with longer expirations. I know time value erosion is our friend but the longer out you sell the option the more time the buyer has to be right. Everything in life is a trade off, I suppose….

And please do take a look at index credit spreads. Nice weekly income without having to buy, or put yourself on the hook to buy, anything. Yet not without risks one must always understand up front. – jay

OK Jay,

will do as you say.

Watch out !!! The tickers I mentioned are just examples of heavyweights.

In my testing of LEAP debit spreads I will now go to Jan 2017 expiry, because 2016 is too close.

I usually buy deep ITM (aprox. 10% under) and sell OTM (aprox. 20% over) strikes.

So, if you look at WBA Jan 2017calls, I like the 85/110 strikes, which would cost today $1,085.00, or less after negotiating, and could yield $2,500.00 if everything goes well.

By the way, WBA just had a nice run, so I’m not sure about it.

Again, I am just a student, so watch out.

I wish that Alan would write a book on these types of trades, because he is so knowledgeable.

Good luck – Roni

Jay, your credit spread seems like an interesting idea for me to try out. I have been enjoying covered calls and consider the BCI method my main strategy. I am always open to learning and exploring new ideas however. I looked into your credit spread and looks like it is called a short strangle (sell strangle). I can see how this works out for you. My question is: on the rare occasions where R2 is crossed and a loss is beginning to occur what exit strategy do you have in place? Thanks for sharing your experiencewith us.

Roni, Jay, members,

There are many perspectives on overall market evaluations and that’s why I always present three in my weekly articles and premium reports. This is also why opinions and ideas from members like from Roni and Jay are so important to us and very much appreciated.

Alan

Alan,

Without you I would not be selling options in all the crazy varieties I do now. I could accuse you of creating a monster :). Instead let me thank you for creating a profoundly better investor. All the best to everyone on this blog. -Jay

Thank you Alan,

It seems like Grexit was avoided, and my over cautious measures made me lose some good oportunities.

I am waiting anxiously for the new Stock Screen next Sunday, to enter more covered call positions.

Sorry for beeing pessimistic. – Roni

Roni,

There’s no right or wrong here…nobody knows for sure what the future holds. On this site everybody’s opinion is respected and appreciated.

Alan

Hi Alan,

I have a few questions for you; I have trade lots call options, I mainly trade it the way like buying the stock, I purchase call option ITM .70 delta. (That was how I been talked option in the past by Investool school) I wasn’t interesting anything else at that time, so I have not talked much notice in the other, and have never used sell call option before, so don’t know what Bid Call delta I should use, what is good rule of thumb for Bid Call delta? Until I know what the Bid –Call number delta is good to use.

I know in your video you never show delta there, I like to use delta to help me understand, I think that will help me a lot, ATM. OTM. And ITM. I like to use delta as clarifications.

Below are the details I intend to use for my AAPL Stock I own

Use Think Or Swim Platforms

July 12 Expiation Aug 15 (40day)

APPL Price $123.85

ATM: Strike $125 Price $3.55 (click sell single Option Premium) Delta .45 Open Interest 76,539

OTM: Strike $120 Price $6.25 (click sell single Option Premium) Delta .62 Open Interest 23,293

ITM: Strike $130 Price $1.79 (click sell single Option Premium) Delta .29 Open Interest 104,662

Am I looking it right way?

I intend to sell the one AAPL OTM Call for $6.25. Not sure is good choice?

I also hear OTM Covered Call is 85% more likely the broker excises their right to take away the stock

Now I don’t like that idea. So what Strike should I used?

Thanks in advance

Christina

Christina,

Although I cannot give financial advice in this venue I can provide you with the BCI approach that should simplify these decisions for you.

I do not provide specific delta stats because the delta of the option will vary from trade-to-trade. One size does NOT fit all. Delta, however, does play a role indirectly depending on the moneyness of the strike you select. Deep ITM strikes have deltas near 1 and deep OTM strikes have deltas near 0. We base our strike selection on the following factors:

Overall market assessment

Chart technicals

Personal risk tolerance

Target monthly profit goal

First set you monthly target for intial returns (mine is 2-4%). Then set your “moneyness”decision. ITM or OTM? Conservative approach with protection or more aggressive approach with opportunity for share appreciation?

Let say you set a monthly goal of 1-3% and you are concerned regarding the overall market. Check the ITM strikes that generate 1-3%, initial returns for the month. The more concern you have for the market conditions, the deeper ITM you go and the further from your 3% target and closer to the 1% target. If concern is moderate go closer to the 3% ITM strike.

So, the greater the concern, the higher the delta. Try to avoid boxing yourself into one specific delta and give yourself the flexibility to manaeuver through the changing market conditions…a respectful suggestion for thought.

Alan

Hi Alan,

Last month I reported excellent results from my call writing but this month I must have committed terrible mistakes. Notwithstanding exit strategies employed, the underlying stocks have so far suffered important setbacks (ANET -9.7%, CYBR -20%, NHTC -19.2%, TASR -3.6%, YY -19.3%). So where did I go wrong? And looking forward, should I consider holding in anticipation of share appreciation, considering the recent sell-off?

Thanks, Anton

Anton,

Take a look at the timing of exit strategy executions. This is critical in down markets. Rolling down, selling stocks under-performing and re-selling same strike options is what will mitigate losses and sometimes turn losses into gains. Position management is just as importasnt as stock and option selection.

The last 3 trading days have not hurt either.

Alan

Alan,

I actually did all three of those exit strategies this past month. They really helped mitigate losses. I even hit my first double which was with TASR. I was still down for the month but it could have been much worse. I learned a lot dealing with a sagging market. Next time I feel I’ll be better prepared.

2 QUESTIONS.

I rolled down twice on CYBR. It hit the 20% rule so I bought it back, I let it recover a bit then rolled down to a lower strike. Then I let it hit the 10% guidline on the new strike so I bought it back. It recovered a bit then I just got out of the position. (Earnings coming up + under performer) I had two contracts so I did something a little different with the other one.

Q1: When rolling down for a second time do you stick to the same 20/10% guideline as I did?

Q2: When selling cash-secured puts, related to this article, at 1% in a down market do you still stick to the same 3% below strike exit strategy or do you exit at 1% below? This question comes from the idea that since the normal target is 2-4% and 3% is the average target so if we lower the profit target do we also needed to lower the exit percentage points?

Thanks for all you do!

Nate

Nate,

Very impressive! Great questions:

1- Yes, same guidelines but at this point selling the security is also in play.

2- Yes again. If you tweek the strategy due to extreme market conditions we also tweek the percentages as you suggest to protect ourselves on the downside.

Keep up the good work.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

Let’s say your stock did not reach its strike price on expiration. I notice some call writers buy the calls back for a nickel and write a new call for the following month. I don’t understand why they buy back the call when it will expire.

Thanks.

Steve

Steve,

You’re right about this being unusual. Some reasons why it may occur:

1- Investor error

2- Concern that if share price is near the strike, it may move to at-the-money slightly after 4PM on expiration Friday and subject to exercise. We can only trade up to 4PM ET but settlement may occur slightly after 4PM…see “pinning the strike” in my material.

3- Concern about share decline over the weekend may result in lower next month premiums for the same strike.

Generally the best approach for strikes out-of-the-money on expiration Friday is to allow the option to expire worthless and write a new call on Monday or early in the first week of the next contract…one less commission.

Alan