Covered call writing and selling cash-secured puts are more conservative strategies than trading naked options (selling calls and puts without having the resources to execute the potential trade obligations, if exercised). A naked call occurs when a speculator writes (sells) a call option on a security without ownership of that security. It is one of the riskiest strategies because it carries unlimited risk as opposed to a naked put, where the maximum loss occurs if the stock falls to zero.

Naked call example

An at-the-money $30.00 call option is sold without first owning the underlying security. Our obligation is to provide shares at $30.00-per-share if the contract is exercised. If share price rises to $50.00-per-share by expiration we are obligated to buy the shares at market ($50.00) and sell at the strike price ($30.00). Since the upside is unlimited, so is our risk.

Naked put example

An at-the-money $30.00 put is sold without first shorting the underlying security (borrowing shares from our broker and selling them at current market price). We are obligated to buy shares at the strike price. Share price can theoretically move to zero defining our risk at the strike price minus the put premium. If the stock was initially shorted, the option risk is lower and defined but there is unlimited risk in the shorted position should the stock price accelerate. Shorting is not a strategy for most retail investors and that’s why we stress cash-secured put-selling and keeping our arsenal of exit strategies on alert.

Conservative approach: Covering our positions

Covered call writing obligates the call writer to sell shares at the strike price, if the call buyer decides to exercise the contract (s). Since the underlying shares are owned before the option sale, the cost basis is known and potential loss due to exercise is measured and known. For example, if we bought shares for $28.00 and sold $30.00 calls and later share price moved up to $40.00, we would be able to relinquish those shares at a profit. If we didn’t first own the stock, we would be required to purchase at the market price of $40.00 and then sell for a significant loss at $30.00.

Selling cash-secured puts obligates us to buy shares at the strike price if the option holder decides to exercise. If share price is $32.00 and we sell the $30.00 put for $1.00 and then stock price declines to $15.00, we would be required to buy shares at 30.00 per share for an unrealized loss of $14.00 per share [($30.00 – $1.00) – $15.00]. Of course, our position management trade executions (like the 3% guideline) will mitigate losses in situations like this.

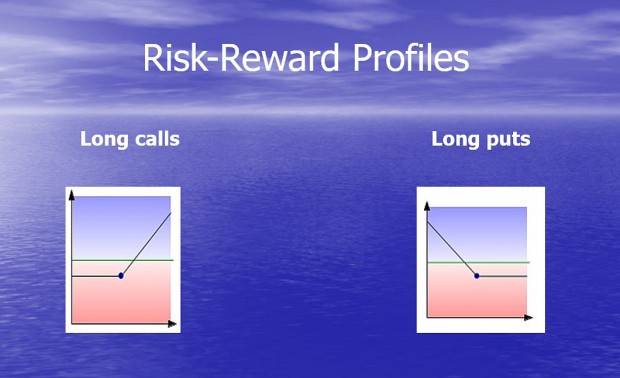

Risk-Reward profiles of long calls and puts

Risk-reward profiles for Long calls and puts

I never liked these graphs because they are deceiving to newbies. It appears that upside is unlimited and downside limited. However, the downside is limited to 100% of our investments. A better way to state the conclusion, is that there is less capital risk with options but we must also understand that our entire investment can be lost.

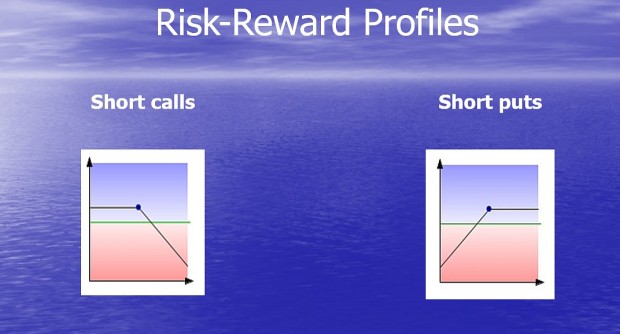

Risk-reward profiles for short calls and puts

Risk-Reward Profiles for Short calls and Puts

Once again, the graphs are deceiving to the beginner. It appears to show limited upside with unlimited downside. The charts do not take into consideration position management opportunities that should be executed when trades turn against us. Also, with covered call writing, we own shares at a known cost basis to mitigate to the upside and in the case of cash-secured puts, we have the resources to execute our trade obligations should share price move below the strike in addition to exit strategies where option positions are closed when trades turn against us.

Why covered call writing increases our chances of winning trades

Nobody, I mean nobody, can reliably predict the price movement of a stock in the short run. There are way too many factors that influence price movement and no matter how sophisticated an algorithm is, it cannot be relied upon 100% of the time. This includes the guys who scream the loudest on TV and radio. Many offer very valuable information but nobody knows for sure. That said, we can certainly throw the odds in our favor by mastering the 3 required skills for option trading…stock selection, option selection and position management.

Looking at worst case scenario and assuming that the odds of a share price moving up in the short-term is 50/50, we can make a case that covered call writing, by definition, increases our opportunities for a winning trade. The reason has to do with the option sale. In essence, this aspect of the trade lowers our cost basis and so we can realize a capital gain even if share price declines by less than the option premium. The tradeoff is that upside is limited by the strike price. So let me go back to my baseball analogy which I have used frequently over the years: covered call writing is a strategy where we will never hit grand slam homeruns. But we will hit singles and doubles all day long.

Discussion

Next live events

- Dallas Texas: October 5, 2017

- Palm Beach Gardens Florida: October 10, 2017: Information to follow

Market tone

Global stocks showed moderate increases this week along with lower volatility and stable interest rates. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), dropped to 11.28 from 14.75 a week ago. The price of a barrel of light sweet crude oil was little changed, at $47.55 versus $47.20 a week ago, despite potential supply disruptions from Hurricane Harvey. This week’s economic and international news of importance:

- According to media reports, senior Trump administration officials and congressional leadership have agreed on an outline for significant reform of the US tax code. The framework includes lowering individual and corporate income tax rates while phasing out popular deductions

- The US Department of the Treasury levied new economic sanctions on several Chinese firms and a Russian firm, as well as Chinese and Russian individuals, for helping supply materials to North Korea’s nuclear and ballistic missile programs

- The synchronized global economic recovery that began about a year ago continues with global purchasing manager’s indices showing that growth is holding firm in most major economies

- Europe showed a strong rise in manufacturing-sector output while in the US the service sector showed strength

- US Federal Reserve chair Janet Yellen spoke on financial stability matters, but did not touch on monetary policy, appearing to favor a more dovish policy on future interest rate hikes

- Gulf Coast refineries are preparing for the potential devastating impact of Hurricane Harvey. Oil and gasoline markets are little changed ahead of the storm’s landfall.

- According to the Wall Street Journal, the US government is considering a ban on the trading of some Venezuelan debt by US-regulated financial institutions

- With 475 of the 500 members of the S&P 500 Index having reported, second quarter earnings are expected to increase 12% compared with the year-ago quarter. Stripping out the energy sector, earnings growth is seen at 9.4%

- Revenues overall are expected to increase 5.1%, 4.2% excluding energy

THE WEEK AHEAD

Mon, August 28th

- US wholesale inventories

Tue, August 29th

- US Case-Shiller home price index

Wed, August 30th

- Eurozone sentiment index

- US Gross Domestic Product

Thu, August 31st

- Japan industrial production

- China purchasing manager’s indices

- Eurozone unemployment, consumer price index

Fri, Sept 1st

- US: Employment report

- Global manufacturing, purchasing manager’s index

For the week, the S&P 500 moved up by 0.72% for a year-to-date return of 9.12%

Summary

IBD: Market in confirmed uptrend

GMI: 2/6- Sell signal since market close of August 11, 2017

BCI: I am currently favoring in-the-money strikes 2-to-1. Next challenge for the stock market is Hurricane Harvey

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral outlook. In the past six months, the S&P 500 was up 3% while the VIX (14.28) moved down by 7%.

Much success to all,

Alan and the BCI team

Alan,

that’s why I love the BCI methodology.

We all believe that our selected stock will go up. Otherwise, we would not consider buying it.

By selling a covered call we can reduce our cost a lot.

For me 2% for one month is a lot.

We limit our upside.

But huge increases in one month are rare, and very unpredictable, especially for us, retail guys.

A recent example will ilustrate :

Buy VEEV on 07/17 @ 63.81 (bold on Barry’s 07/14 list).

Sell VEEV 08/18/2017 60.00 C for 5.76, ROO = 3.4% (volatility).

Cash invested: 5,805.00 per contract.

VEEV at expiry : 62.38. Call exercised. Gain = 3.3% after deducting comission (excelent)

On 08/22 VEEV closed @ 65.82, so no upside relinquished, even if timed to perfection.

Today VEEV is @ 55.81, despite beat on 08/24 ER

Risk reduced a lot by avoiding ernings report.

Roni

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 08/25/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

We have also uploaded the September edition of the “Blue

Chip (DOW 30) Report”. You can find it in the “Resources/Downloads” section of the Premium Member site.

Best,

Barry and The Blue Collar Investor Team

Options are really great. There seems to always be a defined risk version of the undefined risk trade. Rather than short a naked call, long a put is the same risk profile. The downside is that it’s a debit trade with a potential 100% loss in a specified amount of time. Most retail traders are better off not being long an option, however. The long side requires the trader to be right on timing, potentially direction, and potentially volatility metrics, etc. all while facing slippage and other transactional and liquidity risks all while holding an asset which has value which is realistically depreciating on a continual basis.

Goeff,

Would you say the same thing to retail guys like me who choose to be long call/put spreads instead of just buying the call or put ?

Though I thank you enormously for being part of our community I am not in the same league with you and Spin on options knowledge. But I am working on it :)!

It seems if someone knows enough about options to make a directional bet then spreading it and buying ITM at least a month out makes sense.

It’s funny but I don’t consider portfolio over writing or even month to month stock buy/writing to be “trading” even though it obviously is :). It seems like straight forward investing since you are looking for a linear long result.

Once you take short positions, sell condors, use straddles or strangles or buy/sell spreads that feels like “trading”! The difference is semantic but meaningful to me as I try to stay cognizant of what I am doing as an “investor” and what I am doing as a “trader”. They can be different.

Anyway, as always, a successful week to all! – Jay

You two and Spin have obviously tried a lot of different things – have you ever heard of a strategy of ‘collecting’ one share in a large number of different stocks (so as to get on the company register) to profit from capital raising offers? (You get the one share by buying and selling the shares, and selling all but one share.)

Justin

Justin,

Jay might be a better source of info for your question but I’ll take a stab at it. I used to do a lot of IPOs, particularly in the late 90’s when most internet IPO’s were no brainer winners. I also did some secondaries, which I assume is what you’re getting at.

In those days, although there were more shares available with secondaries (lower demand than IPOs), it was still on a broker allocation basis. My guess is that it’s different today in the internet era. It would seem to me that selling OTM puts or verticals would achieve a better purchase price and involve less hassle, fewer commissions and avoid the need to track of a large number of different positions.

Spin

Justin,

I have not heard of your collection strategy. I most often use the sale of OTM cash secured puts as the method to obtain blocks of stock, obviously in 100 share increments.

Spin,

I appreciate your comments and always helpful insights below. I have to say that on aggregate I have done better as a net seller of options than as a buyer. But Buying them is just so damn much fun when you catch a winner :)! Yet in the end this is real money and there is no substitute for doing your homework and understanding probabilities. – Jay

Don’t you guys ever get capital raising offers from companies in the US? I’ve only ever done this on the Aussie market (no plans to try it in the US – I prefer cc’s.) A recent example: I own one share in Bega, worth the princely sum of $6.50. Bega was raising capital and offered me up to $15,000 worth of shares at $5.25 (it was currently trading at $6.50, so almost a 20% discount.) I naturally sent them the $15k and a week later received the shares and sold them for a quick profit of over $3500. Since I have at least one share in over 1400 different companies I get a lot of such offers…

Justin

Justin,

such an interesting story !!!

I wonder :

1400 shares. If the avarage value of each share is $6.50, that would be $9,100.00 tied down, which maybe could generate more cash with CC writing, and would be much more fun ?

Roni

Justin,

Interesting sure winner of $3500 by just owning one share.

Explains…why I did not play the PowerBall 700 Million last Wednesday. Did not believe I was a sure winner.

Mario

Wouldn’t bother with cc’s on the Aussie market Roni – big spreads, poor volume, high fees, and only available on the biggest stocks anyway. Strange though that we should get lots more capital raising offers than US stock holders – ‘Share Purchase Plans’ and ‘Rights Offers’ they’re called.

Justin

Jay,

Covered calls are no more conservative or risky than short puts. The same holds true for covered puts and short calls. In both cases, there’s an imbalanced R/R ratio. The abuse comes from naked leverage.

Vertical spreads are equivalent to collars. They reduce the adverse affects of time decay as well as mitgating that imbalance, shifting it closer towards 50/50 depending on the strikes selected.

See: https://www.thebluecollarinvestor.com/protective-puts-the-collar-strategy/

Note that bull put spreads are equivalent to bull call spreads (same terms). The same holds true for bear spreads so it’s worth considering selling the spread because if all goes directionally as planned, the options expire and frictional costs are reduced.

A nice feature of a bull put vertical is that if it drops and you are willing to own the stock, you can roll the long leg down, lowering the cost basis (you can do the same with the collar). I have an XOM position that’s going to be put to me. By rolling down, my cost basis is currently about $1.50 less than had I just sold the short put – by no means a winner but far better than had I just sold the short put.

Spin

Spin,

I am an XOM retiree with a pile of ESOP shares that have been dead money for a while except the dividend that did not offset the decline. It has, however, been a good one to sell overhead call spreads or buy put spreads against. -Jay

Jay,

Yah, I may be trying to catch a falling knife with XOM :->)

This may sound a bit contradictory but because the exchanges reduce share price by the amount of the dividend on the ex-div date, the dividend will never offset the decline because it is the reason for the decline (the aggregate value of dividends received). Any loss above and beyond that is due to actual price decline (more selling than buying). It requires share price appreciation to recover the dividend reduction and turn the dividend into Total Return. IOW, in and of itself, the dividend is a return of your investment capital.

Spin

*Rather than short a naked call, long a put is the same risk profile.”

Not true. Check a risk graph.

“The downside is that it’s a debit trade with a potential 100% loss in a specified amount of time. Most retail traders are better off not being long an option, however. The long side requires the trader to be right on timing, potentially direction, and potentially volatility metrics, etc. all while facing slippage and other transactional and liquidity risks all while holding an asset which has value which is realistically depreciating on a continual basis.”

Timing, direction and volatility affects the seller as well. High delta call LEAPS have merit for long ownership since they offer lower risk.

There’s no inherent edge of selling options over buying options. If there was, traders would arb the difference. Option buyers have limited risk with large potential reward (some extreme Div Aristocrat examples this year are TGT, CAH, GWW). Option sellers have limited reward with large potential risk. It’s the application that makes the difference.

Thank you, Alan, – Great Article on Naked Versus Covered Trading.

Your Exit Strategies for Covered Calls and Cash Secured Puts increase the odds to increase the reward from our initial investment by not letting the trade sit idle and just waiting it out while price swings either up or down before Expiration Friday.

Yet nothing is guaranteed and one must stay alert. Keeps those memory cells busy.

Mario

Is anyone else having problem with the Blog comments being forwarded to your email?

With the new line in the side menu:

“Subscribe Here – Have the latest blog articles sent to your inbox”.

It does not seem to work for me.

Mario

Mario,

I have asked my tech team to look into this matter. I am currently out-of-town on baby-sitting detail for my 2-yo and 5-yo grandsons. Today I’m thinking of teaching them how to read a technical chart…either that or Lego-Land…we’ll see.

In the interim, try re-starting your computer as this matter may have recently been addressed. I’ll follow-up as needed.

Alan

Alan,

Please split the difference and teach them how to make a bar chart with Lego :)! All the best…..- Jay

Alan,

I remember, when I was that age, my preffered amusement was digging a hole in the sand with a small tin can.

But that was long, long ago……..

Roni

Jay, Roni,

The picture speaks for itself…final decisions made by Seneca and Jordan.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

I am a new subscriber and want to ask you about the BCI Weekly Summary from the Premium Report.

What does “I am currently favoring in-the-money strikes 2-to-1” means? How does it relates to the other summaries (IBD, GMI, etc)?

Thanks you and regards,

Ronnie

Ronnie,

This means that, based on my overall market assessment, I am currently selling 2 ITM strikes for every 1 OTM strike. If I sell 21 contracts, 14 would be ITM and 7 OTM.

Welcome to our BCI Premium Member community.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

Next week’s ETF report will be published on Tuesday as we are moving our main office from NY to Florida next week. All articles, reports and shipments will be sent in a timely manner.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

An ‘interesting’ start to the Sept contract – I waited a few days to really get started due to the scary looking indices last week, then managed to buy into EDU just before it tanked. I also failed to notice that CTLT had changed it’s ER date from August 3 to August 28 (sneaky devils) but was lucky there 🙂 Anyone still looking to put cash to work, the CORT 15’s, MITK 10’s and UCTT 22.50’s look good value. Also watching LITE, SINA and HTHT to put some more cash to work.

Justin

Alan,

Regarding getting the Blog comments in my email… I rebooted my computer, cleared TEMP folder in my PC, Cleared Cache, cookies, and all Browsing Data in Chrome. When I try to subscribe to theBlog comments, I enter my First, Last name, then my email address. Press on Subscribe and I get a blank screen.

I then went to Internet Explorer, Logged in BCI, Performed the same as above, and again I get a blank screen.

So this issue is still unresolved. I cannot guarantee it is not just my computer but funny nobody in the blog has stated that it is or is not working that you get Blog comments in their email once they subscribe..

I did a search in my email for Justin, Jay, Spindr0 and the last blog entry that I received was on Aug. 4, 2017.

Mario

Mario,

My tech team is looking into this matter. Thanks for the heads-up.

Alan

** XME Unwind – Dead Profits finally resolved / Comments on ROO% Basis **

Finally sold my current stock only position of 600 shares of XME after the recent rise of the stock price. Stock price was 32.1847 (after fees) or 8.06% down from my purchase price of 35.008. Including the income from the covered call, net loss was -$1362 or ROO% Gain loss of – 6.49%.

See below for analysis of the position. Note the comments in A3 and C3 below where I compare the ROO% used in the Alan’s BCI Methodology with the alternative Gain% using the Net Investment Basis of the position.

History:

2/13:

A1. ROO% Gain; Sold OTM Covered Call at 35.008 Purchase Price, Strike 36, STO at 0.6762 (52Wk High 35.21), Gain 0.6762, ROO Gain% 1.932% (0.6762 / 35.008).ROO Cost Basis 35.008,

A2. Alternative Net Investment Basis: Initial Investment including Call Income (Equal to BreakEven point) is 34.3318 (35.008 Purchase Price – 0.6762 Premium). Gain using Initial Investment Basis: 1.970% (0.6762 / 34.3318).

A3: Comments on two gains calculated:

**Notice the numerical difference in the percent gains calculated in A1 (ROO%) and A2 (Net Investment) is less than 0.04% or on a percentage basis less than .02% .

** Many articles on Option consider, when calculating returns, a position’s net investment basis for a covered call to be the Stock price less the premium from the option (ITM or OTM). As long as the Time Value or Numerator portion in the Gain equation is within a certain range for the Stock Price (OTM case) or Strike Price (ITM case), the difference is not significant. (See C3 below for additional comment on this.) I have found the difference not to be significant for the typical gain values being used in Monthly Covered call trading.

2/23:

B1. BTC 20% Rule implemented, Close Option Leg

** Premium down for 20% Rule, Underlying was at 32.65 or 6.73% down from Purchase Price of 35.008.

** New BreakEven after BTC 34.4554 (34.3318+0.1236).

** Gain at this point is +32.65 – 34.4554. = -1.8054. ROO% Gain at this point is -5.15% (-1.8054 / 35.008).

B2: Alternative way of calculating gain and ROO% with Cost Basis 35.008:

** Stock Gain: 32.65 (Sell) – 35.008 (buy) = Gain -2.358

** Option: 0.6762 (Sell) – .1236 (Buy) = Gain +0.5526

** Total Gain: -2.358 + 0.5526 = -1.8054.

** ROO% Gain -5.15% (-1.8054 / 35.008).

8/29: Unwind position Sold 600 shares at 32.1938 (Before fees)

C1. Sold Stock at 32.1847 (After Comm/Fees) or -8.06% down from Purchase Price of 35.008.

** Net gain: 32.1847 – 34.4554 (BreakEven) = -2.2707. (600 Shares loss is $1362.42 (600 x 2.2707)

** ROO% gain = 6.49% (-2.2707 / 35.008).

C2: Alternative way of calculating unwind Gain and ROO% with Cost Basis 35.008:

** Stock Gain: 32.1847 (Sell) – 35.008 (buy) = Gain -2.8233

** Option: 0.6762 (Sell) – .1236 (Buy) = Gain +0.5526

** Total Gain: -2.8233 + 0.5526 = -2.2707.

** ROO% Gain -6.49% (-2.2707 / 35.008)

C3: Gain of position using Net Investment basis

** From A2 above, the Net Investment basis is 34.3318.

** Gain using this basis is -6.61% (-2.2707/34.3318).

** Notice the numerical difference between the ROO% gain and the Net Investment percent gain is 0.12%. or on a percentage basis less than 2%.

Additional comment on the Dead Profits issue:

Question: Was it worth holding onto XME for 5 months to unwind it at a favorable price or would it have been better to unwind it immediately at a larger loss earlier in time?

I generally have been successful in holding on to losing stock position for a short while and unwind them a good price peak or at a value near my breakeven point. But that did not happen with XME. It kept declining. my hopes was since it was an ETF it could reverse its course within a reasonable time.

Unwinding in March:

My net investment in XME was 20,599.20 on 2/13/17 including the income received from the sold call. I could have sold the position around 3/17 and released $19,500 (loss of $1099.20) for new covered call positions.

Assuming I could average 1.5% per month that meant lost income of around $292.50 per month or in 5 months $1597.03 compounded monthly. Net gain in the position would have been $497.20 after 5 months, if I am successful each month in attaining 1.5% gain.

Unwinding in August:

My actual loss (C1 above) after the 5 months was $1362.42. In the 5 months the loss in the position once reached to around a value of $-3855.00.

The difference in lost funds between the two choices after 5 months is $1859.62 (+497.20 -(-1362.42)) but could have been worse if the stock had not recovered. Since I had only on stock position with this problem in my portfolio I am satisfied with the results. I was lucky in the fact the stock recovered or otherwise I would have accumulated significant losses over many more months.

Mario

To our Texas and Louisiana subscribers,

Our thoughts and prayers are with you. We hope that you and your loved ones are safe and will get through this crisis quickly.

Best,

Alan, Barry, and The Blue Collar Investor Team

Trading Experiences from Expiration Friday 8/18.

.*****

Last Expiration Friday 8/18:

Covered Calls – Rolls:

I rolled out EDU , Rolled Out and up PYPL

CSPuts – Expired Worthless – a positive:

KWEB

Expired Worthless:

QQQ, KWEB, HLT (all have new Option leg positions

For the Rolls, I purposely watched the Time Value of the options and executed them at 4:30pm (PYPL – 1 positioin) and 4:45pm (EDU – 4 positions in parallel at Optionhouse/Etrade and Fidelity ) for an additional $500 income due to Time Decay.

****

After Expiration Friday:

Dead profits finallly converted to Cash:

XBI ($2j00 loss), XME (Purchased 2/13/17 $1300 loss, recovered price somewhat)

New covered call positions:

ATHM, ALRM, EWW

Long Positions – Buy-Wait Strategy:

ALGN (Trying out Jay’s Buy-Wait Strategy – Purchased 8/18/17 when market dropped several hundred and this stock at the same time Gapped Down as a buying opportunity). Purchased at 170.09, now at 174.88 (2.84% Gain).

Ready to add today 8/31/17 OTM Option Leg for additional income of 2.1% (Total 4.99%) and a great 2.7% downside protection.

****

Portfolio Performance to date:

July 21 Expiration Friday to Aug. 18 Expiration Friday: Gain: 0.5% (not a great month, but previous cycle was 3.1%).

YTD on my Portfolio is 14.5%, 21.8% annualized.

****

Per Alan’s muliple suggestions, I finally made time to review FINVIZ.com web site. Hope to write Blog comment on how I use FinViz with the Premium Report to help me more efficiently and quickly select Candidates for trading and other insights of the site.

.****

.

Mario

Mario,

Great stuff, thanks for sharing, congrats on fine YTD results!

Glad your ALGN has recovered from your buy point. You used “Buy-Wait” perfectly: you bought a broad market dip not related to ALGN. It was just a boat in the tide and you let it come back up.

Now you could even write ITM and still have an underlying gain in addition to your premium! It;s just a tactic that works best on stocks you are bullish about, buy on dips and have a little patience to wait them out before you cover them. It doesn’t work all the time but what does :)?

I have been impressed by the resilience of this market. When the Yo-Yo in N.Korea tested his latest missile early this week I thought we were in for a terrible day. It looked that way at the start then we were green at the end and since. There is still a high “Wall of Worry” to be climbed in September: Yo-Yo Boy isn’t going anywhere, debt ceiling and government shutdown are looming, Harvey recovery funding and the usual crummy September seasonality. We may need the cushion of the things that are working now.

Figuring it would be a good month to portfolio over write I pushed my expiry out to Sept 29th to coincide with the US govt funding deadline since if there is market damage to be done it will happen by then. – Jay

Mario,

ALGN up 1.06% today. Hope you have not covered it yet :). But that time is coming soon. Cover at the next overhead resistance level if it holds. Regards, – Jay

Jay,

Thanks for the heads up but ALGN covered at Strike 175 with the stock around 174.88 for premium 3.64. With my Cost Basis at 170 that’s an addition 2.2%. With the upside potential to 175 that’s 5.1% Return if Exercised. If I had not sold the call it would have gone done with my luck.

If I roll at Expiration i will do even better.

I like it when on a rising stock I can catch it ATM for maximum Time Value. Or I can catch a gap down stock near its Strike ATM value as well and it is a buying opportunity.

I see EDU has recovered its downturn. Does that often.

Currently I am a little concerned about the NKorea / China situation. Sanctions against China for various reasons could affect investments if it gets to that point. Should we continue to invest there? China does not seem to take it seriously enough in trying to limit NKorea’s program’s to the point where it will reach a critical flash point, whether intentional or accidental.

Mario

Good to see EDU moving back up! 🙂 The CTRL 25’s are looking good btw, just added a few myself.

Re the BCI email it never worked for me – I don’t mind, I get too much email anyhoo.

Justin

Money Expo: An Online Webinar Event:

Monday October 9, 2017

3 PM ET

Online event hosted by The Money Show

Alan will be a featured speaker at MoneyExpo, which is the biggest online-only premier event for traders and investors across all traditional asset classes.

Registration link and information to follow.

9/1/17:

Alan:

I sse EDU declared a special dividend today:

From CNN Money:

EDU Special Dividend: EDU will begin trading ex-dividend today with a $0.45 special dividend payable to shareholders of record as of 09/06/17.

Dividend.com also has the same dividend information and prior history of similar dividend announcements..

Option Names were adjusted: For the Calls at 80 Strike, the new adjusted name is 79.57. Optionshouse and Fidelity renamed the options in their system.

Here is an article Alan wrote for a similar event in 2013:

https://www.thebluecollarinvestor.com/when-strike-prices-disappear-contract-adjustments/

A similar special dividend was also declared on 9/1/2015.

The Classic Encyclopedia covers Non-Standard Options on page 193. Does this special dividend make it a Non-Standard option?

Not sure what the consequences are from this with regards to my purchase price and future actions like Rolling at Expiration.

Any special actions for us later?.

Mario

Mario,

Thanks for that, was news to me. Great day for EDU anyway. I see the payout date is Oct 6 – being a foreign investor I believe there’s an automatic 25% tax (can anyone confirm?)

Justin

Justin,

I confirm.

The broker will credit your account 75% of the dividend, and pay the tax of 25% automatically.

All non residents are treated the same by the US authorities.

Roni

Mario,

The dividend is a return of investment capital. Because it is special (unexpected), the strikes are adjusted. It has no effect on you other than it lowers your cost basis and strike as well as getting a new option symbol.

For example, if you bought XYZ for $98 and sold a $100 call (2 pts OTM) and there was a $1 special dividend, your cost basis would be reduced to $97 and the strike to $99 (2 pts OTM). In both cases, you stand to make the premium plus the $2. This is different from a standard dividend where the fly in the ointment is if you are assigned prior to ex-div and you don’t receive the dividend. This presents two scenarios which can result in two different returns based on what the stock does post ex-div. .

There is a subtle difference in quality of premium available when a special dividend is large and the strike being written is ITM or OTM, favoring taking the position prior to the dividend. But that’s getting a bit deep into the weeds. For ATM strikes, it’s linear and makes no difference.

Spin

Spindr, Justin – Thanks for the comments and for information on the impact of the special dividend.

I have 1200 shares in 4 positions, 300, 400, 200, 300. Will comment further in the next blog. They were all OTM last Friday 8/25 with Last Price 77.79 Stiike 80 and Gain of 3% and now they are ITM with a special dividend. Nice set of events.

****

SpinDr – Will also comment later on my current reading of McMillan’s Book Options as a Strategic Investment and the Study Guide.

The Book came as an Inter-library loan from Nashville Public Library 1029 Pages!, Fifth Edition (2012) – Tremendous book. Clarifies a lot of questions I had.. Will have to check it back in and then checkout again from some other library for me to fully read the book. It is available from Barnes and Noble for $60.00 but that is for a later decision while I can check it out for free.

The Study guide is from the Broward County Library. 4th Edition – Still useful since it covers the basic chapters.

.****

Another thing on my plate… IRMA in the worst scenario may hit South Florida around Sept. 12… That is the I take off to NYCity for a 4 day vacation to see a few Broadway shows and sights.

That is also Expiration Week…

Things to ponder.

Mario

.

.

Mario,

30+ years ago, I spent a summer by the pool with the first edition of McMillan’s “Options as a Strategic Investment”. I read many chapters multiple times. For those on the learning curve, I recommend the 3rd edition which can be picked up used at ThriftBooks.com for under $4. There’s no need to fork over $60 or more for the 5th edition until one gets much higher up the options food chain and interested in more sophisticated newer products and strategies. I’ve seen it used for $35 – $40 but the best deal is always the library :->)

I’m also in the path of Irma. It’s been a good long stretch without that hassle. Well. fingers crossed but looking for my water wings, just in case…

Spin

Mario,

Check out these links for articles I have published in the past on this topic:

https://www.thebluecollarinvestor.com/when-strike-prices-disappear-contract-adjustments/

https://www.thebluecollarinvestor.com/special-1-time-cash-dividends-for-stocks-with-improving-technicals/

Alan

Justin:

Advantages of Blog comments coming in your mail:

A1. It simplifies your life if you can get the Blog comments to come in your email. A2. You can delete the email after reading the text. Gmail throws them away automatically after 30 days. (You can also force deletion immediately, if you wish) B1. You can mark those comments important to keep B2. You can mark those comments you cant to revisit later. B3. You can mark those comments you do not have the time to read. B4. You can mark those comments you want to reply to later C. You do not miss any replies that are buried in earlier comments. D. You do not have to visit BCI site and search for replies links.

Gmail:

I finally figured out a simple system with Gmail to mark my emails. I have always had problems on how to mark my email with a system I could remember and use effectively. I use a green-check for completed emails. Yellow-Star for review later for less important items. Red-Star for Hot items to get to later (replies, reviews, important to keep. In Gmail settings you can just enable those flags and in what order then can appear.

For example I can search gmail for “BCI Has:Red-Star” and all the BCI emails I need to reply or review or important to keep are selected. Search for “has:red-Star” and I get all my important action items or important to keep.

Search for “has red-Star -put “bearish market” and I get all emails which are important for reply or review that does not mention the word “put”.but does mention the phrase “bearish market”. Result was a January 24, 2016 BCI email from Alan Ellman on Covered Call writing Inverse ETFs in extreme bear markets.

Mario

Alan,

Thanks for your last response. Re EDU and it’s special dividend, I’d just like to confirm that I’m plugging the right numbers in 🙂 They paid a special div of 43c (after the 2c bank fee was taken out as you mentioned to Mario). Thus my strike price of $85 was altered to 84.57, and would I now change my stock purchase price from the original 8.50 to 8.07 and leave it at that? (I managed to close my position on Wednesday at 8.90 for the options and 93.59 for the stock – handy since I have to wait T + 2 before I can use the funds again.)

Best, Justin

Justin,

Nice going!

As the spreadsheet shows, without the dividend, your 1-month realized return in this trade is 3.4%. Adding in the $0.43 dividend as a credit, it becomes 3.9% (share credit + dividend -option debit divided by cost of shares).

Keep up the good work.

Alan