Selling Cash-Secured Puts can be used to accomplish several goals;

- Generate cash flow

- Buy a stock at a discount

- Used as part of a multi-tiered option selling strategy along with covered call writing (PCP strategy)

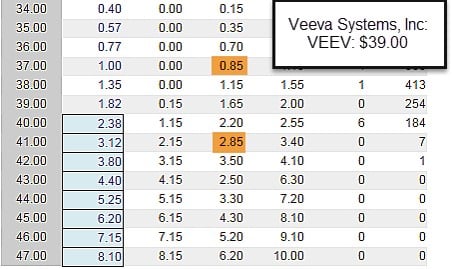

Our strategy goal along with overall market assessment, chart technicals and personal risk tolerance will ultimately guide us to the most appropriate put strikes price to select. When viewing an options chain for puts it is apparent that in-the-money strikes (higher than current market value) will generate the highest premiums. This is because there is both an intrinsic value component and a time value component. At-the-money and out-of-the-money strikes only have time value components to the option premiums. Let’s evaluate both in-the-money and out-of-the-money strikes for Veeva Systems, Inc., a stock on our Premium Watch List at the time I am penning this article (we are viewing 3-week returns).

Put options chain for VEEV

Options chain for VEEV 8-26-2016

With VEEV trading at $39.00 per share, I have highlighted the $37.00 out-of-the-money put strike and the $41.00 in-the-money put strike. Both strikes are precisely $2.00 from the current market value price of $39.00. On first glance, we see the $41.00 strike offers more than triple the premium than does the $39.00 strike but the question is which strike is best for our goals?

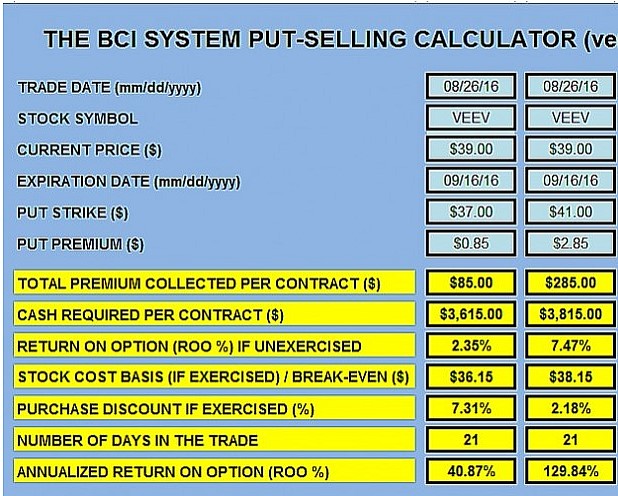

VEEV Put-Selling Calculations

First, notice that the time value components of both strikes are precisely the same. The out-of-the-money $37.00 put is all time value (0.85) and the in-the-money $41.00 put also has $0.85 of time value ($2.85 – $2.00). Given the equality of time value, the strike selection, to a great extent, will be based on our goals which must be identified prior to entering every trade.

Thought process leading to strike selection

Buying a stock at a discount

The in-the-money $41.00 strike will more likely be exercised (at a 2.18% discount). The $39.00 strike will only be exercised if share price drops below $39.00.

Using in conjunction with covered call writing

Since exercise is not an issue, both strikes are in play but since our goal is still cash generation, using the out-of-the-money strikes will give us sound returns and protection to the downside (7.31% in this case).

Using for cash flow only

Here we use the out-of-the-money puts. The more bullish we are, the closer to at-the-money we go. If we are strongly bullish I would favor out-of-the-money covered calls giving us the opportunity to generate two income streams in the same month with the same investment.

Discussion

The moneyness of put strikes is dictated by strategy goals, overall market assessment, chart technicals and personal risk tolerance. Selecting an in-the-money put strike to generate higher premiums is not a reason for strike selection because the loss of share value on the stock side will counterbalance the additional put premium.

Upcoming live events

1- February 27 and 28th, 2017

Marriott Marquis Hotel, NYC

1:30 PM ET (Monday)

1:30 ET (Tuesday)- This presentation will be webcast by The Money Show

Exhibit Hall Booth 208 (February 26th – 28th) … come say hi to the BCI team

2- March 21st and 22nd, 2017

Two live Florida events (Fort Lauderdale -22nd and Delray Beach- 21st)

3- April 12, 2017

Income Generation Webinar for The Options Industry Council

4- RECENTLY ADDED

AAII National Investor Conference

American Association of Individual Investors

November 3rd – November 5th, 2017

Loews Royal Pacific Resort

Orlando, Florida

Details to follow

Market tone

Global stocks continued moving higher on increasing evidence of improved US economic growth and rebounding inflation. Major US indices again rose to record highs during the week, Oil prices dipped, with West Texas Intermediate crude at $53.50 a barrel versus $54.10 last week. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), edged up to 11.37 from 10.9. This week’s reports and international news of importance:

- After a run of strong economic data from the United States, hopes intensified this week that the reflationary period underway since late 2016 would prove more durable than the four prior upturns during the current business cycle, which began in early 2009

- January retail sales rose a better-than-expected 0.4%, while December sales were revised up 1% versus a previously reported 0.6% advance.

- Firmer consumer prices at both the headline and core level, buoyant manufacturing output and upbeat regional Fed manufacturing surveys—particularly the Philadelphia Fed’s manufacturing index — which soared to a 33-year high — added to investor optimism

- After a series of strong economic reports, markets expect the US Federal Reserve to hike rates in the first half of 2017, perhaps as soon as next month’s meeting of the Fed’s rate-setting committee. Chair Janet Yellen said that it would be risky to wait too long to raise interest rates and that the committee would consider hiking rates in coming meetings

- Donald Trump’s pick for treasury secretary, Steven Mnuchin, was confirmed by the US Senate this week and sworn into office shortly thereafter. Tax reform is expected to be Mnuchin’s early focus with Trump unveiling his tax reform package in the next few weeks

- The International Monetary Fund and eurozone finance ministers remain at odds over the direction of the Greek bailout process. Without that relief, Greece’s debt is unsustainable

- With 75% of S&P 500 companies having reported (as of February 15th), aggregate earnings are up 5.2% year over year while revenues have grown 4.3%. According to Hedgeye Risk Management, if these trends hold up, the fourth quarter of 2016 will be the first time in two years that companies will have generated positive earnings for two straight quarters

THE WEEK AHEAD

MONDAY, February 20th

- Presidents’ Day holiday- None scheduled

TUESDAY, February 21st

- Markit manufacturing PMI, Feb.

WEDNESDAY, FEB. 22nd

- Existing home sales- Jan.

- FOMC minutes

THURSDAY, FEB. 23rd

- Weekly jobless claims

FRIDAY, FEB. 24th

- New home sales- Jan.

- Consumer sentiment index Feb.

For the week, the S&P 500 was up by 1.39% for a year-to-date return of 4.89%.

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of November 10, 2016

BCI: I am currently fully invested and have an equal number of in-the-money and out-of-the-money strikes. I remain defensive despite all the positive signs based on the lack of clarity regarding the policies of the new administration.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral to slightly bullish outlook. In the past six months, the S&P 500 was up 8% while the VIX (11.37) declined by 6%.

_____________________________________________________

Wishing you the best in investing,

Alan ([email protected]) and the BCI team

Hi Alan,

ANET had really a terrific performance. Wow.

I sold on 02/08 at 98.00, and made a very nice 5,4% gain on my covered call trade.

This was a terrific month.

All my calls were exercised, average 2.5-3%, and I am 100% in cash, waiting eagerly for the new list tomorrow, and to start all over again next Teusday.

I liked the article on “in the money puts”, but did not fully understand it. Must read it again more carefully.

Roni

Hey Roni,

Congrats on a great month!

Being 100% cash is a great thing though painters often say a blank canvas is intimidating and writers often get blocked looking at a blank PC screen :).

It is the perfect time with a long weekend to relax, take a breath and think about how to flex these strategies for March expiry.

You have always been good about listening to my two cents so. I’ll share with you how I am setting up my March expiry. If you are smart you will use me as a contrary indicator and do the opposite of everything I say :)!

I too have a large cash position. I am not bullish since seasonality is crummy and Trump gets more unstable every day. So if I buy anything it will be on pullbacks. if I then sell any covered calls it will be on upticks. This is not the time to do both transactions on the same ticket or day in my opinion. – Jay

Thank you Jay,

I always listen to your wise words, and exchanging thoughts with you is very helpful.

By following Alan’s methodology, I am confident to get fully invested during this next week, and sell the March expiry covered calls.

I will choose some tickers from Barry’s list, and must look at some others for extra diversification.

My risk tollerance will not let me place an order without selling simultaneously the covered call for some protection.

I believe that the market can continue to rally for some time, as money from the sidelines is flowing into stocks in great volumes. But some stocks may pull back after strong gap ups.

I will stay mostly ATM or near the money, and will pull the plug on 5% losses.

Take care – Roni

Thanks Roni,

I am happy you are having a great year at this early juncture!

I suggest to friends not nearly as market sophisticated as you but who know it is my passion and ask – dangerously – for my advice that trading is tough! Few beat SPY. As you know SPY is the largest publicly traded ETF and mirrors the US S&P 500 index.

I suggest to them if what they are doing is beating SPY rock on! If not consider buying SPY and devoting the time to other hobbies :)! – Jay

Got it Jay,

I do not consider myself very sofisticated, but I share your passion, and love to hear your suggestions.

Tale care – Roni

Roni,

So glad to learn of your recent success…made my day!

After re-reading this article, let me know if you need further clarification on any of these points.

Looks like we have a large list of eligible candidates for the watch list published last night. Keep an eye of the 23 candidates that did NOT have adequate option liquidity as of market close on Friday…still a large number of stocks with adequate open interest.

Thanks for sharing and keep up the good work.

Alan

Thanks Alan,

I read the article again, and now I understand it completely.

My personal preference is cash flow only, and therefore, as you say, it all depends on how bullish you feel to choose the OTM strike, closer or further from the ATM.

Roni

Roni,

Keep checking the”Open Interest” W (OI) on the stocks that did not have enough OI on the current report. Since we are at the beginning of the option cycle, many of them should have added OI as the option cycle continues.

Best,

Barry

Thank you for the tip Barry, I apreciate it and will check the OI carefuly each day.

Roni

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 02/17/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article,

“Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Hi Allen,

Great to see so many candidates on the new running list this week. But I still have a problem to diversify at 5 industries (as you recommend in your book) since most stocks are in financials and tech.

Yes, I made out good last month.

Thanks,

Fred

Fred,

Yes, finance/banks/S&L dominate our watch list this week and for the recent past as well. Other industry segments represented this week include:

Electronics

Chips

Software

Insurance

Medical

Business services

We also have our ETF Report if further diversification is needed.

So glad to learn that you enjoyed a successful month recently.

Keep up the good work.

Alan

Alan- You sell a covered call and the underlying goes thru the strike price in week 1 or 2 of a 4 or 5 week option cycle. When is the ‘ideal’ time to buy back the option and sell the stock? Is it when the delta of the option hits .85-.95? Prior to this there is too much time value left in the premium that you would need to buy back and also for every dollar that the underlying goes up, you are still making a little because the the delta is not 1.

Peter,

I view and establish these sort of important decisions based on practical, rather than theoretical applications. Let’s say we bought a stock for $48 and sold the $50 call for an initial 1-month return of 3%. Now let’s say the stock price moves up to $53 (for a total 1-month return of 7%) and we are considering the mid-contract unwind exit strategy.

Rather than focusing on Delta (although this does show your impressive advanced knowledge of the Greeks), I prefer to evaluate the time value cost-to-close. We know the cost to buy back the short call will be $3 (intrinsic value) + a time value component. Since the $3 is compensated for by the “bought-up” value of the stock (from $50 to $53), it is the time value that represents our real cost-to-close. Use the “Unwind Now” tab of the Elite version of the Ellman Calculator for exact calculations as shown below.

Let’s further assume that we are in the first half of the contract and the “ask” price to buy back the option is $3.30. This means that the actual cost-to-close is $30 per contract or 0.60% based on the current (real) value of the stock which is $50 based on original option obligation. See image below.

The question we ask ourselves is can we generate more than 0.60% on a completely new position in the current contract month. I would require at least a return of 1.60% in this hypothetical.

To sum up: I focus on actual time value cost to close and compare that stat to the returns that can be realized in a new position in the same contract month.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

You can use the “What Now” tab on the Ellman Calculator and see what options, no pun intended, you have. You don’t always want to jump just because a stock suddenly runs up unless it’s a very legitimate reason like a buyout which is more than a rumor, etc. Stocks go up and down in a contract month.

Some things to consider, option pricing is on a curve (convex/concave) and extrinsic value is not the same across all strike prices, accordingly. The reason is that, if you sell an ITM call, you’re selling off some of the risk of price decline. The opposite is true in selling OTM calls, you retain the rights for a stock price to appreciate while the buyer needs all of that and then some just to breakeven (at expiration, anyway, disregarding price changes in-between but that’s also “priced in” anyway).

You can roll-up, roll-up-and-out, buy it back and sell something else, etc. If you roll up, you need to watch transaction coats and you WILL be increasing your risk as you’ll have more money in the trade. I executed the roll-up with NVDA a few times last year. I sometimes paid $80 to buy $100 of appreciation. With a strong run up in price in a liquid option you can sell more time premium with a roll-up.

Buying back and deploying the cash into another security is also acceptable as there may be more extrinsic value during the same timeframe in another security. In short, just do the math and the rest will follow.

I hope this helps! Happy trading!

Yes it helps Geoff.

Before the recent expiry, most of my trades were in this situation at some point, and I had to do rhe math as you say.

All the alternatives involve more risk, and the BCI goal is : Consistent gain at low risk.

Every time when one of my stocks gets a bounce, I feel more protected, and hope it will stay there till expiry.

Roni

Hello Mr. Ellman:

Is there a covered called algorithm to determine whether one should write in-the-money, out-of the-money or at-the money?

By the way I did buy your Cashing In On Covered Calls book, which is very informative.

Georgia

Georgia,

Any algorithm developed to determine strike price selection would need to factor in:

Overall market assessment

Personal risk tolerance

Chart technicals

Return goals

Algorithms are only as good as the equations fed into them and must reflect our individual trading styles. Probably not practical. The human decision-making abilities we have will give us an advantage over those who depend SOLELY on equations developed by others. Software programs are essential to our success but ultimately we must pull the trigger on our trades and management techniques.

One size does not fit all. I am currently selling an equal number of ITM and OTM strikes. Many of our members are more aggressive than me at this time, some less so. There is no right or wrong here. We can also “ladder” strikes and sell some ITM and some OTM for the same underlying. When in doubt favor the more defensive positions (ITM calls, deeper OTM puts).

Here is a link to an article I published on this topic:

https://www.thebluecollarinvestor.com/selecting-a-specific-strike-price-for-our-covered-call-positions/

Alan

I have a query regarding trades and account size.

In your opinion, would there be enough diversification to trade five positions on a $200k account (i.e. $40k positions) or would you suggest increasing it.

Thanks for any advice.

Greg

Greg,

5 positions is our minimum requirement for diversification with individual stocks (less with ETFs…good for investors who want to manage fewer positions or have less cash available to invest)). With an account of $200k, we have an opportunity for greater diversification that I believe should be taken advantage of as long as management is not a problem. The number of stocks we manage should also be based on our comfort level once the minimum threshold is met. For me, I would consider at least 10 stocks , with no 1 stock or industry representing more than 20% of total portfolio position. An average range would be from 8 – 15 positions.

Alan

Alan,

In lesson 4 you say to favor call options with a “minimum open interest” of 100 open contracts and/or a bid-ask spread of 30 cents or less.

Please tell me why the bid-ask spread of 30 cents or less is important.

Many thanks,

Arturo

Arturo,

I include the “$0.30 or less” with the option liquidity guideline because there are some contracts with less than 100 contracts of open interest that still have a reasonably small bid-ask spread and therefore should be regarded as eligible from a liquidity vantage point.

The reason that liquidity is important to us is that we may be in a situation where an exit strategy opportunity may present itself and the tighter the spread, the less time value we will pay to execute the trade.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates. For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

question about the Daily covered call checkup. What are the “todays option price” and “option Sale price”?

Is todays option price, the “Bid or Ask” for the strike?

Is the Options sale price the Bid or Ask for the strike?

Please elaborate

thanks,

Amos

Amos,

Bid for option sale price (what we actually receive)

For current option price:

I use ask price if spread is small

I use mid-point of spread (“mark”) if spread is wide (what we would pay to buy back)

Alan

Alan,

Re: Incorrect Ex-Div-Date in Run List for NTES, Dividend Strategy, Greeks over 7 month time period

I have attached an interesting and educational image I created using Fidelity’s Active Trader Pro in a Watchlist.

This all started when I placed and filled on 2/21 an In-the-Money Buy-Write contract 100 shares NTES @ 293.66 after commission, STO 1 Cn 290 Call @ 10.555 ExpF 3/17 after commission.

Actual Net Debit Limit order $293.61-10.61=Limit 283.00). ROO% before commission 2.4%. After Commission: ROO% 2.38% with Downside protection: 4.63%. BreakEven 283.1 OI was 549, Spread $0.20)

Incorrect or not updated Ex-Div Date in Run List:

In placing my trade, I noticed from your run list an ER of 5/1 and an Ex-Div Date (Comments column) of 5/23/16 (originally I thought it read 2017). The confirmed date for the next Ex-Div is 3/1/17. It pays annually $3.30, Yield 1.12% or .0.28% per quarter.

I was particularly sensitive to the Ex-Div date issue since I was surprised on the morning of 2/14 that my position of ZION 600 shares had been assigned and shares sold (Ex-Div was 2/14 but order was traded on 2/13) by the holder . I then proceeded to do some research and also read your comments on the subject (Classic Encyclopedia 398, 443.

As I see it, as a writer or seller of the option, there are no consequences if I am assigned since I will still yield the ROO% on the position. I realize you can prevent an assignment by rolling the option at some time value loss if you want to guarantee you will will retain the stock (overwriting of Leaps situation). Do you concur?

Option Holder or buyers of the call do have choices, and as you explain, if the option is trading at more than parity (Time value 0) the holder can Sell to Close the call to reap the time value and buy the stock before the Ex-Div Date to capture the dividend. If at Parity (TV=0), you can exercise it to buy the stock and save some commission. If you take no action as an Option holder, call value will decrease by the dividend.

NTES image with Greeks Columns.

Regarding the attached NTES image. It shows for the next 7 months Options chains for the next 7 months period (weekly for 5 5 weeks, then monthly with columns for the Greeks.

It shows clearly what happens to the time value as Expiration approaches with actual numbers. Just as you have mentioned many times, the last two weeks it drops quickly. The progression for time value for 5 weekly periods is 9,8,7,5,4,2 which correlates with the negative Theta column while intrinsic value column stays constant. Delta stays constant throughout, and Gamma (change in delta) increases as the time period gets smaller.

Notice also in the progression, the difference in Time value stays relatively constant at 1.3 out of time values of 9,8,7 for 3 weeks and the last two weeks changes by 1.9 out of time values of 5,4, and 2. So I see what you mean by waiting till the next cycle begins to sell a call instead of purchasing it 5 or 6 weeks out, where time value loss per week is less, avoiding the increase in risk with the additional time.

Regards,

Mario G.

Security: NTES

Mario,

I appreciate all the time you took to research and now share all this valuable information.

First a comment about ex-dates and our premium reports: Over the years, we have found that dividendinvestor.com is the most reliable resource in this area and we use it as our go-to resource for this stat. As with all resources (yes, even BCI), we can never achieve or locate perfection. As of today (Thursday), the ex-date is still listed as May, 2016…see screenshot below. Yahoo Finance has it as November, 2016. Some comments:

1- If our focus is solely income generation and not also collecting dividends (my approach), then share assignment can be viewed as a positive. That is because we have realized and maximized our trade and now have the cash from that position freed up to perhaps initiate a second income stream in the same contract month, much like the MCU exit strategy.

2- I agree that rolling the option prior to the ex-date will eliminate the chance of early exercise related to dividends but let me add 3 other approaches:

– Use Weeklys for that contract month (when available) and skip the specific week of the ex-date.

– Write the call the day of (or next day) the ex-date

– Write a 2-month option moving the expiration date far from the ex-date. This will decrease the chance of early assignment.

3- Share value will drop by the dividend amount on the ex-date so option value may drop as well but the dividend distribution has already been factored into the pricing models by the market makers. Call values are less and put values are higher due to ex-dates.

4- I love your graphic representation of the logarithmic nature of time value erosion. This demonstrates how time value erodes slowly at first and then precipitously as expiration approaches. This guides us as to when to sell options and the best way to manage our exit strategies. Your statistical graphic representation of these concepts are extremely helpful in corroborating these concepts.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Hi Alan,

I’m only new to the options game but was wondering if you ever do ‘bull put credit spreads’ on any stocks? From what I’ve been reading they obviously limit downside risk which is apparently a downside to cc’s.

Justin,

Back in the day I paper-traded several low-risk option strategies and had (by far) the greatest success with covered call writing. I am, however, a firm believer that those who master all 3 required skills (stock selection, option selection and position management), success can be realized with al low-risk strategies. I do believe that all beginners should start with covered call writing because it is intuitive, the easiest strategy to achieve broker approval and can be used in sheltered accounts. From there, selling cash-secured puts would ne next and other strategies can be tested from there. Ultimately, we will favor the strategies that work best for us best on our trading style and personal risk tolerance. For me, it is covered call writing and selling cash-secured puts.

Alan

Thanks Alan, yes there’s certainly a plethora of strategies out there, with lots of different opinions as to their effectiveness. And I agree that paper trading is certainly the best way to practice – just started using IB’s platform for that and it seems to do the job.

Justin,

As you develop your option trading skill set, you can use our Weekly Premium Reports to help you select stocks (and ETFs) for execution of Bull Put Spread trades.

Best,

Barry

Hi Barry, yes I’ve been using the report stocks to set up some paper trades, trying to evaluate the pro’s and con’s of cc’s, put selling and credit spreads. Fortunately I have plenty of free time

since I’ve got a large income from a stock market strategy of my

own that most have never heard of – profiting from capital raisings.

It’s quite simple – just own at least one share in a large number of

stocks (circa 1500 in my case) and get deluged with capital raising

offers. The trick is in buying and selling the stocks without losing

your shirt 🙂

To all:

Its only Week 1 of 4 and I on 2/23: XME (Metals and Mining SPDR ETF) Buy to Close BTC 6 contract 36 Call Exp 3/17 at 20% of my purchase price.

Let’s see if I can Hit a Double in the 3 weeks that are left.

This ETF was No. 1 on the 2/10/17 ETF Summary.

Mario

Mario,

Nice work! I’m working the same underlying, XME, as well.

Best,

Barry

Time to hit the double! XME up 3% today.

Terry,

My position: XME 500 shares Last Price 3/1/17 33.34, My Original price 35.01 and strike 36. BEP 34.46 Cost Basis 35.01: Current Gain 3/1/17 = (-$669.2) ROO -3.18%

Did not think it was the right time for XME to roll down since a. I am still below my BEP; b. ideal Hit a Double is at the original price and strike or close by; and c. there is still 17 days left in cycle.

If I had performed a STO at strike 33.5 with a bid of 0.99, my new ROO% gain would be -3.18% + (.99/35.01) = -.36% or a loss of (-$75) on 600 shares. (Ignored small upside if stock rises past 33.5.

If the price of XME stays low, in Week 3 or 4 I could either Rolldown OTM to help me out or unwind at a price peak.

I hope XME and another Stock (TTMI) I am holding for a double do better in the next two weeks!

Another alternative I was considering is biting the bullet and cash out both positions and accept the $1250 (3/1/17 last prices) in losses, then purchase new positions. Looking at that would give me $38000 in cash and at a realistic 2% that is only $760 in income. Looks like waiting is better.

Mario

Mario;

Yes it appears that XME needs to bounce higher for the numbers to work out for you to hit the double.

Thanks for sharing and best of luck!

Terry

Hi Alan,

Thanks for this article. My goal is growth and I’m still working so my risk tolerance is pretty high. I’m 36 with a stable income (thankfully).

Therefore, can you discuss what the risks are of Selling I’m deep ITM Put options to generate the greatest premium and ROO?

For example, the current price of APPL is $134. If I Sell a Put at $142, I get a $8.20 premium. If APPL pops I have to buy at $142.

Since I got that Premium, it’s as if I bought at $134 (current market price). I have no problem holding on to APPL for the long term. If the stock is exercised, then I’ll sell CCs on it.

Is the biggest risk that I lose downside protection? Does that matter if I am OK holding for a long time?

Thank you! I really appreciate the membership, books, videos, etc.

Moiz,

If share price remains under the $142.00 put strike, the contract will be exercised and the shares “put” to us at $142.00. Since AAPL is trading at $134.00, that would represent a share loss of $8.00 per-share at the time the trade was entered. Since the premium is $8.20, only $0.20 is time-value initial profit.

If AAPL moves above the $142.00 strike, the contract will expire worthless and we will have generated a huge option profit.

Use the BCI Put-Selling Calculator or the Elite-Plus Calculator (our best) to guide us to the best trading decisions:

https://thebluecollarinvestor.com/minimembership/calculator-elite-plus-calculator/

https://thebluecollarinvestor.com/minimembership/elite-put-selling-calculator-2/

Alan