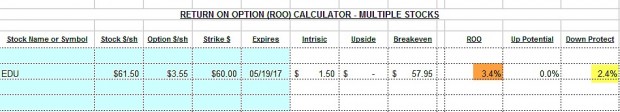

When we sell an in-the-money covered call, we are taking a defensive posture and using the intrinsic value component of the premium to protect the time value initial profit. As an example, let’s look at New Oriental Education (NYSE: EDU) on April 7, 2017:

- EDU priced at $61.50

- $60.00 (ITM) call priced at $3.55

- Expiration for the May contract is 5/19/2017

Initial profit and protection calculations using the Ellman Calculator

EDU Calculations using The Ellman Calculator

The results show an initial time value profit of 3.4% (brown field) with a downside protection of that profit of 2.4% (yellow field). This means that EDU can drop up to 2.4% by expiration and a 3.4%, 6-week return will have been realized. From an option-seller’s perspective, in-the-money strikes offer an alternative that can be employed when markets are bearish or volatile, when chart technicals are mixed or when the option-seller has a low risk tolerance.

This begs the question then as to why option-buyers are willing to spend the additional cash to own these strikes. After all, we are getting an insurance policy protecting our time value and that protection is paid for by the option-buyers, not us.

Reasons why in-the-money strikes are purchased

The Delta factor

ITM strikes have the highest Deltas as shown in the screenshot below (yellow

ITM Strikes have the Highest Deltas

A Delta approaching “1” means that the options will change in value nearly dollar-for-dollar with the underlying security. If the option holder is anticipating a significant share appreciation by contract expiration, it could result in an impressive percentage return because of the much lower cost basis of the option compared to the underlying asset.

Portfolio hedging

Frequently money managers will seek a Delta-neutral portfolio to mitigate against market risk. This where positive and negative Deltas neutralize each other. For example, if stocks were shorted resulting in negative Deltas, buying ITM options to mitigate with positive Deltas may be appropriate.

The in-the-money strike may have been an OTM strike previously

The moneyness of an option changes based on the price of the underlying security. If an option buyer purchased a $50.00 call when share price was $48.00, that option was out-of-the-money at time of trade execution. If shared price then moved to $52.00, that same strike is now in-the-money. The Options Clearing Corporation matches up buyers and sellers of options and those trade executions were probably not executed at the same time.

Discussion

The use of in-the-money strikes has its advantages and uses for both option buyers and sellers. There will always be a market for liquid stocks and exchange-traded funds (ETFs) for out-of-the-money and in-the-money or near-the-money strikes. Understanding when and how to use in-the-money strikes is one of the skills that will definitely put additional cash in our pockets.

Next live events

- Dallas Texas: October 5, 2017

- Palm Beach Gardens Florida: October 10, 2017: Information to follow

Market tone

Global stocks were flat for the week. An increase in volatility was a result of concerns that White House turmoil could impact President Trump’s pro-growth agenda. Adding to volatility was a terrorist attack in Barcelona that killed 14. These events moved the Chicago Board Options Exchange Volatility Index (VIX) back up to 14.26. The price of West Texas Intermediate Crude oil dropped to $47.20 a barrel from $48.20 last week. This week’s economic and international news of importance:

- Both the Fed and the ECB sent more dovish signals than the markets were expecting regarding monetary policy normalization

- There is concern that inflation is not moving toward the central bank’s 2% targets These concerns call into question the pace of future Fed hikes and the timing of an expected taper in ECB asset purchases

- After several high-profile defections of corporate CEOs from two business advisory councils, President Trump this week dissolved the councils

- North Korea regime announced this week that it will not target the area around Guam, a US island territory in the Pacific Ocean

- President Trump signed an order this week directing the Office of the United States Trade Representative to conduct an investigation into China’s trade practices with regard to intellectual property theft and the forced transfer of technology in order to be granted access to Chinese markets

- The British government published several position papers this week, laying out detailed viewpoints on border issues between Northern Ireland and the Republic of Ireland as well as on the need for a transitional customs union following Brexit

- Japan’s economy expanded at a 4% annualized rate in the second quarter, far exceeding expectations of a 2.5% rise

- With 92% of the members of the S&P 500 Index reporting, Q2 earnings are expected to increase 12% compared with Q2 2016. Excluding the energy sector, earnings are expected to advance 9.3%

- Revenues are seen growing 5.1% overall and 4.2% when excluding energy companies

THE WEEK AHEAD

Tue, August 22nd

- Eurozone: Economic sentiment survey

- Canada: Retail sales

Wed, August 23rd

- Global: Preliminary purchasing managers’ indices

- United States: New home sales

Thu, August 24th

- US: Jackson Hole Fed symposium begins

Fri, August 25th

- US: Durable goods orders

For the week, the S&P 500 moved down by 0.65% for a year-to-date return of 8.34%

Summary

IBD: Uptrend under pressure

GMI: 1/6- Sell signal since market close of August 11, 2017

BCI: I am currently favoring in-the-money strikes 2-to-1. The stock market has been incredibly resilient given the global and domestic political concerns. It is not clear how much longer this durability will last.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a mildly bearish outlook. In the past six months, the S&P 500 was up 2.5% while the VIX (14.26) moved up by 23%.

Much success to all,

Alan and the BCI team

This transaction for ABMD was executed in a virtual account at the COBE.

On 8/10 I sold (STO, first balloon) 1 contract, cash secured PUT at a strike price (redline above) of $155 with an expiration of 8/17 (AMBD Aug17 155 Put).

At the time of sale, the stock price was $155.85 so my option was just OTM. I expected the stock to remain above $155, but was open to take the stock so that I could then practice selling covered calls on the stock. I know this option sale was for a very short time cycle. But for practice it seems to be illustrative.

On 8/12 the stock dropped significantly.

As your methodology suggests I evaluated the situation and felt the drop was an overall market drop and the stock was still a good asset. So, I decided to hold the option. I also expected on 8/12 or 8/13 that my option would be exercised. The option owner could have netted a about $500 profit if they waited until the stock price was around $150. Yet the option was not exercised.

The stock price remained below my strike price for 2 more days (8/14 and 8/15). My option was not exercised. The stock then went to my strike price and slightly above in the following days. I had expected the option to expire by end of day 8/17, the expatriation date. However, it did not seem to.

On 8/18, one day after the stated expiration day, the stock dropped again and my option was exercised by end of day 8/18.

I have a couple of questions to help me understand this behavior.

1. Why did the option holder not exercise the option on 8/12 or 8/13 when the stock price dropped significantly? I know we cannot determine for sure what the option holder will do. However, if I was the option holder I would have exercised the option and taken my profit. Is this typical behavior? That is, on a PUT when stock price drops well below the strike price some time during the option life (not close to expiration) that it would not be exercised?

2. The expiration date was stated as 8/17. If by end of day on 8/17 my option was transacted it seems like it may have not exercised because the stock price was then about $154,1 dollar lower than the strike price. There seems to be something “special” that happens on expiration date. For example, the exchange wakes up and says “oh its past expiration day, the stock price is lower the strike priced, so put the stock”. And at other times in the life of the option the option owner must initiate the transaction.

3. Why did my option not expire or get exercised on the end of day 8/17? That was the expiration date. Why did it go one more day? Is this typical that true expiration is 1 day later the expiration day? In this case it was bad for me because the price dropped farther on 8/18.

4. Could I have bought back the option (for a small loss), if I wanted to prevent the PUT, early on 8/18? One day after the expiration date? Or because it was after the expiration date I am not able to do anything?

I now got to practice with covered calls!

CLICK ON IMAGE TO ENLARGE & USE THGE BACK ARROW TO RETURN TO BLOG.

Thanks,

Ron

Ron,

These are very valuable questions you ask. My responses:

1- The main reason early exercise is so rare is that the option buyer will capture intrinsic value but lose time value. The better path would be to simply sell the put option and capture both. Only 10% of options are actually exercised. The remaining 90% are either closed prior to expiration or expire worthless.

2 and 3- Expiration Friday was on August 18th, not the 17th. You saw 8/17 which represented August 2017, not August 17, 2017…tricky. This explains why the option didn’t expire worthless while out-of-the-money on the 17th…the contract month had 1 more day left and that day saw the option move in-the-money resulting in exercise.

4- Yes, we can buy back the option (buy-to-close) anytime prior to 4 PM ET on expiration Friday to avoid assignment of calls and puts.

Congratulations on paper-trading and asking such critical questions.

Alan

Ron,

Another consideration – which does not seem to a factor here because your CBOE paper account exercised like the real thing – is some broker provided paper accounts don’t act like the real options accounts would and some folks here getting started might want to be aware of that.

When I started many of my ITM paper trades on cc’s that I knew should have been exercised were not after expiry so I was getting inflated account balances because I was keeping both the premium and the higher priced stock. Wouldn’t it be nice if the real world worked that way :)?

When I called to ask why they simply said “Hey, it’s a paper account, there is nothing to really “exercise” and it’s mostly programmed to track stocks”. So not all paper trade accounts have the same sophistication though it does not surprise me CBOE has a good one. -Jay

Great point by Jay. Virtual accounts do have limitations but, with that in mind, they are critical tools we must take advantage of for those new to option-selling before risking our hard-earned money. Once we master the 3 required skills, we now have years and decades to benefit.

Alan

Ron,

Just for clarity of discussion, the owner of the option exercises and the seller is assigned.

1) If the option has any time premium remaining, exercising the option throws away that time premium so it makes more sense for the owner to sell to close in the option market. If there was no time premium remaining, it would still make more sense to STC the option because doing so incurs fewer commissions.

2) You have the expiration date wrong. It was the 18th. The Option Clearing Corp (OCC) doesn’t suddenly wake up then. Prior to expiration, they assign positions as holders of long options exercise them. Unless indicated by the owner to “Do Not Exercise”, all options $0.01 ITM are exercised and assigned at expiration. You can avoid this by BTC your short option during any trading day since after the close, the OCC uses a ‘wheel” to randomly select who is assigned with notification the next morning.

There are multiple reasons for early exercise.

1) The owner of the option doesn’t realize that he can close the option in the option market (see #1)

2) The option owner wants to be long (or short) the stock after exercise or he wants to close an existing stock position (exercise long put to sell his stock or exercise long call to cover a short position).

3) Dividend Arbitrage: The time premium of a put is less than the amount of a pending dividend. Many web sites mistakenly state that it occurs if the call premium is less.

4) Discount arbitrage: The option trades at a negative intrinsic value (the bid is less than intrinsic value) and the owner is going to have to take a haircut to STC the option. If you execute at this inferior price, the market maker will exercise it to book the difference. Exercise by the investor is the the way to avoid this, assuming the amount of the haircut is less than the commissions incurred. I’ll leave these arbs at that unless someone wants a detailed explanation.

August expiry weekend report:

Total account value : Down 0,4 %.

3 positions called away

1 CC expired worthless, break even if I sell underlying at Friday close price.

2 positions rolled out and up to 09/15/17

1 unwind with small gain

1 CC bought back @ 20% of premium, holding stock temporarily

1 CC bought back @ 10% of premium, holding stock temporarily

I am 40% in cash, waiting for the Weekly Stock Screen to select the trades for 09/15 expiry.

Roni

A creditable result Roni since I calculate the Russell 2000 (RUT) Index was down 6.2% over the contract period. I’m very happy with my 1.75% profit even though it was a maxed out 2.7% in early trade Thursday – my 2.85% profit the previous month means my mostly ITM strategy is beating the RUT by a handy 9.4% 🙂

Justin P

Can I get a copy of your spreadsheet with add-ins?

Tom H

[email protected]

Thanks Justin,

well done, congrats on your results.

My FIZZ and VEEV trades were exercised, gained 4% and 3.3% respectively.

My STLD call expired worthless, position now at break even.

Roni

Roni,

Thanks! Trading STLD the Jay Way by waiting to sell the option could work well again, seeing it’s such a volatile stock – not sure

how useful or not that method would be with slower moving stocks.

Tom,

My sheet displayed above is actually a workbook of all the most useful BCI spreadsheets, (all linked programmatically) so I should confirm first, are you a BCI member? 🙂

Justin

Hey Justin,

You really are a master with those spreadsheets and workbooks -what a great skill to have! Just logging on and typing a note is an achievement for this old computer illiterate :).

Thanks for your kind and funny mention of the “Jay Way” as I have long been an advocate of Buy/Wait over Buy/Write.

My method when it comes to shorter term call selling remains pick your stock based on sound criteria (Barry’s list), buy it on a down day, let it run up a bit to get some separation between your buy point and the market then sell your call on an up day a little OTM to give it more upside run room and get a premium. This assumes a generally rising market as we have had. I suspect it will not work as well if one is buying in a down trend.

Since Buy/Wait takes more time and patience it will often throw you off the standard monthly expiry cycle such as began today. I use higher volume stocks that have weeklies so I can create my own “expiry” and steer around earnings and ex div dates. – Jay

Have liquidated my STLD position at a 1.3% loss. Not happy, but no big deal.

Now fully invested again, entered PYPL, CNC, ATVI, and NVDA near the money 09/15/17 CC trades (buy/writes. Sorry Jay, no confidence in my nerves)

Roni

Roni,

Best of luck with your new buy/writes. My style is only that :)!

That’s a nice foursome and I hope you hit target with each! – Jay

Jay,

Thanks, but practice makes perfect, I’ve been using Excel since ver. 1.0 circa 1989. The real masters are at excelforum.com, ask them anything about Excel for a quick reply – just don’t get into a conversation with any of them at parties 🙂 Re Buy/Wait I’m not sure yet how much I’ll use it, maybe more often in ER months when there’s not many stocks offering good premium, since I’m only sticking to monthlies at the moment.

Roni,

You’re braver than me, I’ve decided to wait at least a day or two before opening some new positions. Just looking at the RUT for instance – rather scary! Here’s a quote today from ‘Rev Shark’ Deporre at TheStreet.com:

“This time the dull action has a different feel. Rather than feeling like it is a pause that refreshes, it feels more like a temporary respite before the selling picks up again. There was nothing about the action today to indicate that a bottom was forming.”

Good luck with those positions anyway!

Justin

Justin,

Regardless of your modesty I still find your spreadsheet skills impressive! Buy/Wait is just a tactic. The strategy remains buy good stocks and over write them for extra yield and loss protection. We are getting a nice bounce today so I will do some over writing.

There is a lot of bearish ink being spilled in the press these days and, ironically, that has a tendency to be bullish since the big corrections come when everyone is in and sentiment is high.

I will likely get fooled again too as I am in the skeptic’s camp with a high cash position.

– Jay

Just sold my PANW stock at some loss, it was left over from last month, and has earnings on Aug 31, so I took advantage on today’s rebound.

At same time, entered a new trade on AAPL for the Sep 15 CC cycle with 2.2% ROO.

Roni

Roni,

PANW has been an interesting stock to follow and I am sorry you sold it for a loss this time. It is too good a company in too good a sector to stay down for long.

I have shares of HACK which is a cleverly named ETF specializing in cyber security. – Jay

Actually it’s possible we might be starting yet another of those ‘v-shaped’ recoveries – Tuesday’s rally actually looked pretty good.

Re PANW I know nothing about it, but looking at the chart I see a long-term downtrend – usually a sign of something fundamentally wrong with a company. After 32 years of analyzing charts I have one very important rule – only buy into uptrends! 🙂

I started my September campaign with the CORT 14’s – a ROO of 3.3% and DP of 3% (and a bullish chart.)

Justin

Jay,

have traded PANW several times in past couple of years, generally with good results

I look at a any ticker just as 1 monyh CC trade, no emotion attached to the stock itself.

If it responds positively, fine, if not, I get rid of it fast, before the loss grows too much.

Thereafter I use the cash for a new trade, especially early in the monthly contract cycle, as happened in this case.

Thank you for the HACK tip,

Roni

Justin,

I Agree with your rule of entering trdes in uptrending stocks.

But I am not very good with charts, so I probably missed the downtrending signs with PANW.

The only chart I look at before deciding, is Yahoo, where I click on 1 day, 5 days, 1 month, 6 months, and one year.

I have not much time, and so, a fast look, plus Schwab Market Edge second opinion weekly, and I’m done.

Roni

Roni,

I understand and respect your use of stocks as monthly vehicles to generate a target return as opposed to things you fall in love with :). Everyone should have your discipline! – Jay

Roni,

The downtrend shows up a lot more clearly in the three-year chart (I use MarketWatch myself), though just a glance at the one-year chart gives me the shudders – it looks more like a good stock for a strategy where you buy a put and a call just before the ER though 🙂 Can I ask what business you’re in as a matter of interest?

Justin

Jay,

my discipline comes straight from Alan’s wonderful books.

Justin,

no problem, my business is fluid power, oil hydraulics high pressure components and syatems.

We distribute, import, build, design, and machine manifold blocks.

Our main customers are in construction, and agriculture.

Sounds impressive, but is just a very tiny company, 50/50 with my partner.

Roni 🙂

Good luck with the biz Roni! – invest the profits in CC’s and you can explain the finer points of options investing to the girls at Copacabana 🙂

Justin

The girls in Copacabana prefer younger Aussie blokes like you to teach them the finer points of Excell, while they can show you the fine points of their string clad blessings.

Justin P.

Buying a straddle or strangle on PANW would have done quite nicely given how much it moved after the past 3 ERs. However, implied volatility of such stocks skyrockets before the ER and you are swimming upstream as you face two obstacles:

1) One side of the straddle is going to lose if the stock moves in the other direction

2) Both sides are going to lose a lot of value because of the sharp IV contraction (mid 80’s down to 30-40)

An ATM straddle for next week could lose up to 2/3 of its value because of these two factors and depending on how fast the IV contracts, it might take a 10-12 point move for it to break even. No problem, given the past 3 ERs but a big one if it goes nowhere.

Don’t let me influence your approach. Just be aware what you are dealing with.

Spin

No probs Spin, only doing CC’s currently myself. Do you have any positions on this month yourself?

Justin

Justin,

My option positions are variations of bull/bear collars and spreads and they’re mostly in the in gold and oil stocks which tend to have some volatility.

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 08/18/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we still are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Additionally, the report for next week, 08/25/17 will be uploaded later than usual. I will be out of the country taking some vacation and will make every effort to have the report in your hands before the market opening on Monday. 08/ 28/17.

Best,

Barry and The BCI Team

[email protected]

Alan

You may like to know that I have signed up for the BCI monthly premium membership a week ago and looking at how things are going, would likely commit to it on a yearly basis.

I find that the weekly premium report is very useful; so much so that my first trade is now profitable (albeit not yet closed) and I need to seek your views on how I could possibly manage it.

I have your Exit Strategies For CCW book and have viewed quite a few of your online videos on exit strategies, but could not find something that addresses the pleasant situation I am in – protecting unrealised profits when the share price has shot up and there is plenty of time to expiration.

After going through the weekly report for 08/11/17, I decided to open a position on ATHM:

On 14 August, I bought 100 ATHM @ $61.95 and sold the Sep17 $65 Call for $1.90.

Last Friday , ATHM closed at $64.41 and the Sep17 $65 Call is now at $2.70.

While the technical chart for ATHM looks fairly okay, recent global events and the charts of S&P500 and VIX are making me cautious.

I wonder if it is possible to apply an exit strategy to protect the unrealized gains of $2.46 per share by doing a rolling strategy.

To close my open ATHM Sep$65C would result in a loss of $0.80.

Some alternatives I am considering:

a. BTC Sep17 $65C @ a loss of $0.80 and sell the shares (profit: -$0.80 + $2.46 = $166 or 2.7%)

b. BTC Sep17 $65C @ a loss of $0.80 and roll out to the Dec17 $65C @ $5.90 (additional premium collectable = $5.10)

c. BTC Sep17 $65C @ a loss of $0.80 and roll out and down to Dec17 $60C @ $8.50 (additional premium collectible = $7.70). I know there is no rolling out and down exit strategy in the BCI approach, but am considering rolling to an ITM strike in view of the not-so-positive market tone.

I am not able to work out the financial effects of alternatives b and c; am not sure if I am missing something here.

Would appreciate if you could offer some advice.

Thank you.

Vincent

Vincent,

We must eliminate emotion from our trade executions and base our action on sound fundamental, technical and common sense principles. Easier said than done!

On 8/14 you took a bullish position by selling an out-of-the-money call. This position was based on overall market assessment, chart technicals and personal risk-tolerance. There was an initial return of 3.1% with a possible additional 4.9% of additional upside potential in this trade.So far, so good.

Now, despite volatile market conditions, the stock is behaving as anticipated based on the bullish assumption. From a stock perspective, nothing has changed.

If our overall market assessment and personal risk tolerance has not changed in a week, no action is indicated at this time.

Let’s assume we are fearful of the overall market. Choice (a) can be considered. Keep in mind that we are spending 4.4% of our initial investment to close. However, that will still leave us with a 2.7%, 1-week return…not so bad. To consider this, our bullish assessment must have turned around 180 degrees in the past week.

Choices (b) and (c) both involve rolling to the December calls. The attraction is the juicy premiums. Don’t be enticed. They will bring you through the next earnings release, breaking one of our BCI rules. Also, we will generate greater annualized returns using Monthlys rather than longer-term options. We also will have more opportunities to re-assess our bullish assumptions with shorter-term options.

Although I never give specific financial advice in this venue, I can comfortably tell you that I would not consider (b) and (c) leaving your decision to either take no action or close at the 2.7%, 1-week profit depending on your current overall market and stock assessment.

Alan

Alan,

The Put videos and Books arrived but I’ve decided to wait. I’ve only been applying the BCI methodology in covered call writing since March and its been working really well. I want to be a full fledged “graduate” of your processes but I find myself torn. I’m a newbie. I’m doing well with covered call writing. I don’t think I need anything else. My profit ranges everywhere from .68 to 7 percent and I accidentally got 19 percent on one stock you recommend. I sold a covered call after hours on a Friday. Literally bought the stock on a Friday and wrote a covered call after market hours and it soared 19 percent. (It was a reaction that normally happens with earning reports.) If I had bought a put and a call ATM with a 60 day expiry but sold it after the earnings report I would have made 31 percent. Holy cow. But I’m more than happy with my/your conservative strategy and my current range of profits of .68 to 7. Sometimes I do .68 weekly on one position, sometimes the combination of rise in stock price with an OTM call gets me closes to Premium profits of 3-4 percent with rise in stock price taking me to 7 percent.

In your experience, should I wait to begin to learn and apply your put strategies? I bought the products and then slapped my own hand with a gentle reminder that I needn’t be greedy to be profitable.

Clare

Clare,

So happy to learn of your recent success. I do agree that starting with covered call writing and then moving to also learning to utilize cash-secured puts is a sound investment plan. Both are outstanding conservative option strategies.

It does seem that you are well on your way to mastering covered call writing. The education for selling puts can begin now and then you can decide if and when to integrate puts into your investment master plan.

One example would be to favor deep out-of-the-money puts in bear and volatile markets before entering a covered call trade (if the put is exercised).

There is no such thing as too much education.

Congratulations on your success and thanks again for keeping our country safe.

Alan

Premium Members,

The Weekly Report has been revised and uploaded. There was a typo in the ER date for VEEV. The ER date should read 08/24/17. Look for the report dated 08/18/17-RevA.

Best,

Barry and The Blue Collar investor Team

[email protected]

Thank you Mr. Ellman for your newsletter, very informative and helpful. Have been able to dig myself out of a hole many times with the calculations you bring up.

John

John,

Glad to help and appreciate your generous feedback.

Alan

I have a friend I talk about the market with almost every day through e-mail. He has been at this crazy game longer than I have. He has evolved into a Trend Swing Trader using SPY and QQQ. I tell him he has taught me a lot about that and he tells me I have taught him a lot about options. This past week he sold all his SPY and QQQ and is 100% cash going forward.

He sees the underpinnings of this rally unraveling with the Trump setbacks, tensions domestically, unrest internationally and the heightened possibility of seasonal corrections so common between now and Nov. 1 being more severe. Plus he had a gain of about 11% which is above his annual target so he booked it lest it only go down in months ahead.

I suggested ways to hedge with options in bearish times. He listened but was most interested in protecting his profits and getting out. He will be back when the storms he sees pass.

As I thought more about that conversation what struck me was not whether I agree with his logic and conclusion – I am mixed on that. But here is a guy who knows his objective, knows his risk tolerance, is not greedy, has a market view and is not afraid to act on it.

I found that admirable. I strive to be that disciplined and decisive. I am sure I would be better at this game if I were! -Jay

Alan,

I’ve been a premium member for a few months and have read and reference your Complete Encyclopedia of CC Writing. Having good success with the system thus far.

My question is about writing a CC within the contract month when the expiration date is less than four weeks and the next out month is farther away than five weeks. Although you may have covered this situation, looking back I wasn’t able to find any references to this type of situation in the book or the available videos. I think I can infer that if I had opened a position on CTRL 1 week earlier and the Call option had dropped to 20% of its original value, I would be buying it back and potentially re-entering a new position which would be the same time frame as entering a new buy-write for the example below.

The question then is, do you recommend a minimum and/or maximum period of time (either calendar days or days to expiration Friday) within a contract period to open a new buy-write position?

Example:

CTRL (Control4 Corp): Just released to the new watchlist

September 15th expiration Friday is 25 calendar days away or 19 trading days.

October 20th expiration Friday 60 calendar days away or 44 trading days.

Regards,

Michael

Michael,

I hold all my positions within the current monthly contract. I generally hold between 15-25 positions involving between 50-100 contracts each contract month (plus a few in my mother’s account). Having all contracts expiring on the same date makes management easier for me.

Our knowledge of Theta (time value erosion) guides us to enter new positions within the first few days of the new contract. When options are rolled, we try to do so as close to contract expiration as possible.

When positions are closed mid-contract (either due to significant share price decline or acceleration) we need replacement stocks and those should be selected from the latest premium report. The BCI guideline is to look to generate a minimum of 1-2% above the cost-to-close to enter new positions. If that can’t be accomplished, I will not close a position where share price has moved up substantially and consider rolling or allowing assignment as expiration approaches.

If I close a position mid-contract because my bullish assumption has changed and I cannot generate 1-2%, I will leave the cash in the account until the new contract begins.

Alan

In your video Ask Alan #137 you make a great point that recovering a 49% loss will take a long time. Please clarify for me how to recover a smaller loss such as 15%. If you sell ITM calls incrementally to get back to even and you are assigned what do you do? Roll up to the next highest strike and continue to do so until the loss is recovered. It seems to me if you roll up you are debiting your account and buying back the loss. Although you could sell the stock after it recovered would you still be making money?

Thank You

Dennis

Dennis,

In the video, Sid lost half his money on share depreciation on a stock he bought based on news alone (President Trump’s impact on the coal industry). He didn’t trust this stock but wanted to retain it so he felt in-the-money strikes would be most appropriate to generate both time value and downside protection. This means that frequent rolling of options would be required but time value profit would also be part of the equation. So, yes, we could still be making money if share price stabilized.

Most importantly, however, in the “discussion and evaluation” section of the video, I make the point that a better approach would be to sell out-of-the-money strikes on a different security with a much more bullish technical chart pattern.

One of the most difficult decisions for retail investors is to walk away from a stock that has declined substantially in value. In Sid’s case, he had a stock worth $18-per-share and now has a stock worth $9-per-share. The question we must ask ourselves is where should that $9-per-share be placed TODAY? In WLB? In a stronger candidate? I vote for the latter.

Alan

Alan,

I am one of those retail investors having trouble dumping losers. I have Under Armour and Target in my portfolio and would have been so much better off if I sold them for better performers a long time ago. Lesson learned.

Marsha

Marsha,

Please do not feel alone. I have been holding some biotech which was also a darling of yesterday going no where fast today.

Letting go of losers we think make fundamental sense is tough. And all it takes is one of them to turn around to validate our stubbornness :)! But most of the time it is wiser to set a stop loss and get out unless you have a long horizon and patience. – Jay

“But most of the time it is wiser to set a stop loss and get out unless you have a long horizon and patience”

Jay,

How do you spell G-A-P? :->0

It takes a very disciplined trader/investor to cut losses. Most people tend to be afflicted with Breakevenitis.

Spin

Alan

If you selll an in the money call lets say for a stock currently at 70 for 65$ and at experation the price is 65.10 can the buyer get it at that price or does it have to be at 65 or less/

DAN

Dan,

For covered call writing, if we sell a $65.00 strike and the price of the stock at expiration is $0.01 or more above the strike and if we do not close (buy back) the option prior to expiration, the option will be exercised and shares sold at the $65.00 strike price.

If share price is below the strike price, the option expires worthless and will we retain the shares.

Alan

What video or chapter talks about buying back a call. Where do I start?

Dan,

Check out any of the exit strategy sections in my books and DVDs.

When we initially sell an option, the trade execution form will read “sell-to-open” or “STO”. When we buy back that same option (usually at a different price) the form link we check is “buy-to-close” or “BTC”.

Alan

Dan,

The call buyer can exercise his call anytime he wants though it makes no sense for him to do so if there is any time premium remaining because he can realize more by selling the option in the option market.

Early assignment often occurs when the call is ITM and trading near its intrinsic value and before a dividend. All options one cent ITM at expiration will be exercised though the owner of the option can execute a “Do Not Exercise” order with his broker.

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates. For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Marsha and Jay,

I am sure many of us have kept some losers with the hopes of unloading it at a favorable loss or better.

Here is a strategy I use to find the best time to unload them as I continue with my investing.

I enter my positions and options for 4 accounts (around 18 positions with 8-10 stocks) in one consolidated Fidelity Watchlist / Portfolio.

With Fidelity’s watchlists, you can enter the Purchase Price and quantity of your purchases (Stocks, Options, Cash, Reserved Cash, Indexes) and keep track of your account value. Up to a maximum 50 Line Items can be entered, which has not been a restriction for me.

With a stock which was a covered call and is currently a stock only position, I update the Purchase Price to my BreakEven Point. So I know I have updated the price to a Breakeven point, I add a 9 suffix to the price like 50.3759.

I then monitor the Gain (Loss) and Gain% of my stock position at all times for an opportune time to unwind the stock. I did that to two positions of XBI recently. I still have one other Stock position, XME which is now moving up in value.

I do the same procedure to a Stock position which had a Worthless Option position on Expiration Friday and has a Earning Reports that next cycle. If the stock has not degraded a lot where I do not mind a small loss or gain I watch the stock for a few days in that first week to see if it peaks for a quick sale before Earnings Reports date. If the gain does not improve, I sell it since I can use the money for a new Covered Call. If the stock price has degraded a lot, I may wait longer for a peak and then sell before Earnings. I have done that recently with MGM (bad decline but then peaked up) and UCTT (because of Earning Reports).

As far as keeping track of the Account Value in the consolidated portfolio, I keep track of my different cash positions by using dummy Money Market accounts (FDLxx, FDRxx etc.) from several companies (Quantity=Cash Value, Price-NAV=$1). Works out great for Reserved Cash (CsPuts) and Core Cash amounts.

The nice thing about Fidelity is that you can set up and manage the Watchlists in a Browser or in their Active Trader Pro platform. As you close an option or sell a Covered call, I can update the watchlist in the platform. I also monitor my Premium and Time Value of the options for the 20/10% Rule (decline of premium) and Mid Contract Unwind scenarios (Rise in Stock price while Time value approaches 0.1% loss).

I tried doing the same Portfolio entries in Yahoo but was not possible. I also found in Yahoo you can enter an option position, but the price does update to the latest price ever. My OptionsHouse/Etrade Platform has only Watchlists.

Do other members know of other online Portfolio/Watchlist tracking methods for consolidating accounts or keeping track of one account with multiple cash positions?

Mario

Wow – perfect example of earning report consequences. Look at what happened to VEEV after Earnings Reports yesterday after closing…. Now 8.7% down at 8/25/17 10:15am.

Sold Covered Call 7/21/17 62.415 Strike 65 OTM

Sold 8/22 at 64.27

I sold my stock on 8/22 at a price rise to 64.27 after expiring Worthless on Expiration Friday – 634.38 profit or 5.08% 4.8%.

Mario

Great trading Mario.

Way to go, always avoid ernings report surprises.

My VEEV trade, ITM, for 08/18 expiry was called away, and I made “only” 3.3%,very satisfied all the same.

Roni

Mario,

Just read your explanation about your watch lists.

My Schwab page has a simple and easy consolidated live list of all my active trades, with a tab for “Market value” and another for “unrealized gain/loss”, which I keep watching all the time.

There are hundreds of other features, many of which I use daily too.

Roni

VEEV not the only one plunging today – anyone know what’s ailing TAL and EDU?

Justin,

I only invest in American companies because they are strictly

regulated by US laws.

Chinese companies are not transparent.

Roni

Justin,

Re: EDU … With no news, either someone is unloading shares pending some news or short sellers have targeted the company. Chinese stocks are often targeted.

New Blue Chip (Dow 30) Report now available:

Premium members,

The September edition of the Blue Chip report has been uploaded to your member site. Login and scroll down to “B” in the resource/downloads” section of your member site.

Alan